Investor activity in SA plunges as bank action bites

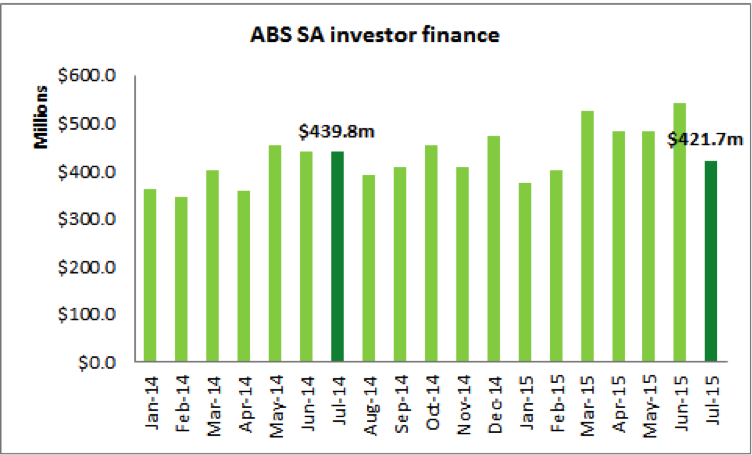

Latest residential lending data from the ABS reveals that the level of investor finance commitments reported over July has fallen sharply in all states except Queensland.

Sharp declines in lending to investors follow recent action by the regulatory authorities to direct banks to tighten lending conditions to this group. The action by banks was designed to moderate perceived risky lending to investors despite price growth in most capital city housing markets remaining relatively subdued.

Investor loans in South Australia fell sharply by 22.2 percent over July to $421.7m according to the ABS – clearly the worst monthly result of all the states.

The July result, however, also reflected a predictable adjustment from the extraordinary all-time record value of investor loans approved in South Australia the previous month at $541.9m.

Despite the steep fall in investor activity over July, the value of housing loans approved to this group in South Australia remains a solid 15.5 percent higher over the first seven months of this year compared to the same period last year.

Residential investor lending accounted for 37.9 percent of all housing finance approved over July, which was below the previous month’s record market share of 45.4 percent.

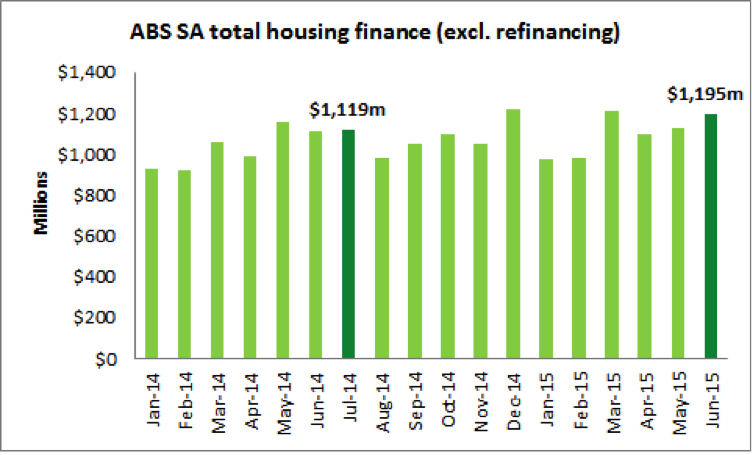

July was, however, a positive month for owner-occupied finance approvals in South Australia, with the value of loans increasing sharply by 5.9 per cent over the month to $691.3m – the highest monthly result for this year so far.

Overall, finance approved for residential purposes, owner-occupied and investment has increased by 5.8 per cent over the first seven months of this year compared to the same period last year. Another clear indicator of the continued solid performance of the local housing market to date in 2015.

Residential investment remains an important driver of economic activity, particularly for the South Australian economy, with latest ABS data reporting the jobless rate remaining the highest of all the states at 7.9 per cent over August.

A solid supply line of rental properties is also important for Adelaide tenants, with recent Domain vacancy rates for houses remaining at a very tight 1.7 per cent over August. Adelaide has the lowest overall vacancy rate inclusive of houses and units of all the mainland capitals at just 1.9 percent.

Shortages of rental properties will continue to put upward pressure on rents with negative consequences for housing affordability.

Dr Andrew Wilson is Domain Group senior economist: Twitter@DocAndrewWilson