The R&D Tax Incentive deadline is incoming

Businesses engaged in research and development have until April 30 to apply for the R&D Tax Incentive for the year ended 30 June 2023.

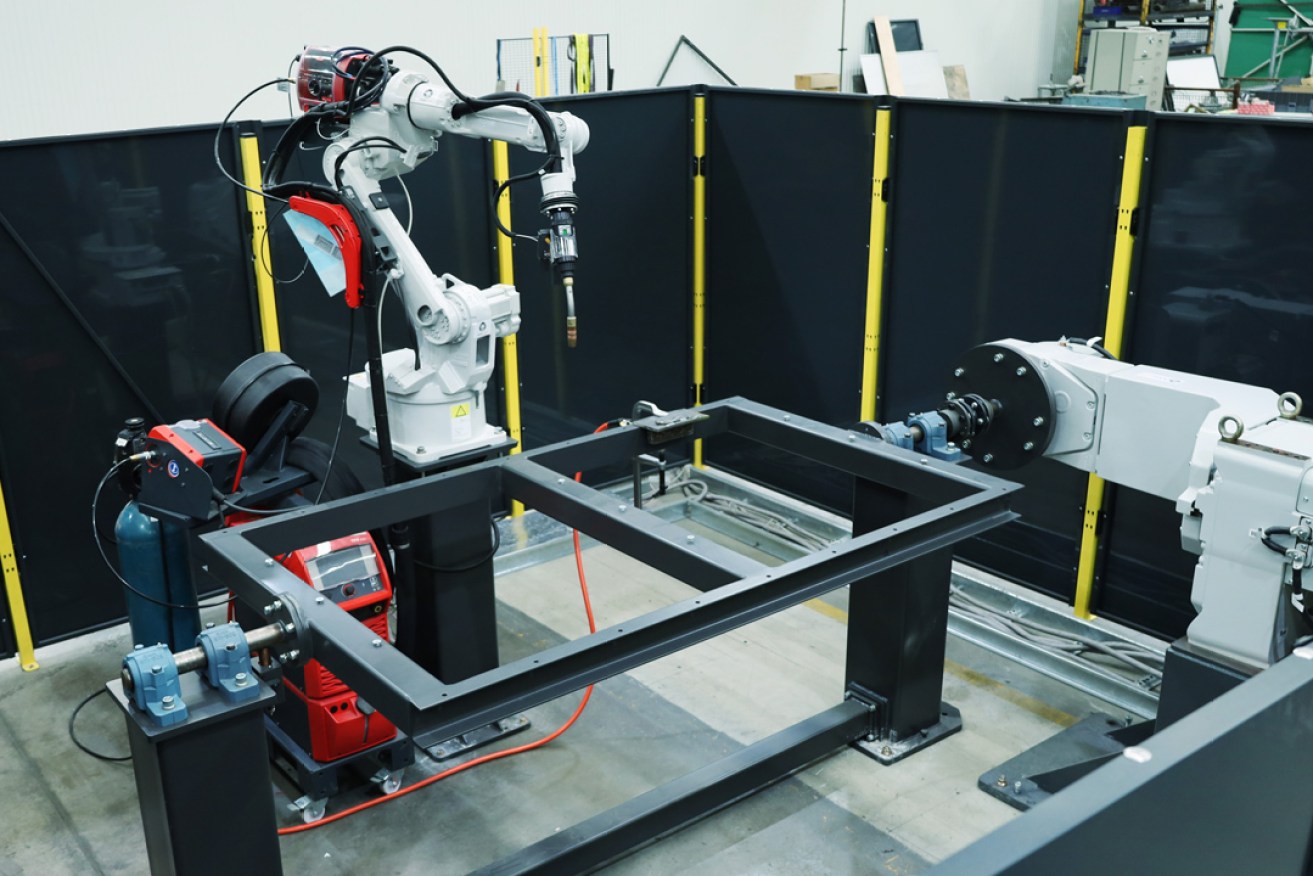

AML3D's robotic welding and additive manufacturing technology will be part of an R&D facility being set up at Tonsley.

Businesses with expenditures on research and development have just over a month to claim the R&D Tax Incentive.

Eligible companies include those with aggregate turnover of less than $20 million, and they can access up to a 48.5 per cent cash refund on their R&D expenditure when in sufficient losses.

For example, companies would receive a $485,000 refund on $1 million of R&D expenditure.

Larger companies that bring in more than $20 million can apply to reduce their tax liabilities, as well as smaller companies that make a tax profit.

Speaking to InDaily, BDO director of R&D and grants Melissa Fardone said the R&D Tax Incentive was an industry-focused program that covers more than just scientists.

“If you’re a smaller company with aggregate turnover of less than $20 million – which is what we deal with a lot of in South Australia with our startups and SMEs – it gives you the opportunity to get cash back on the money that has been spent on R&D activities,” Fardone said.

“In the current environment, it could mean quite a lot – they could get back potentially 43 and a half per cent of the money that they’ve spent on eligible activities.”

Significantly, FY23 is the final year for taxpayers to benefit from the overlap between the R&D and the Temporary Full Expensing (TFE) provisions.

This means, if a business has purchased assets used in R&D activities during the year that also meet the requirements for TFE, there’s potential for a significant uplift in their claim this year according to Fardone.

“For example, say a business accessing the 18.5 per cent refundable R&D incentive purchased an asset for $100,000 with an effective life of 5 years. This asset was held for all of FY23 and used exclusively for R&D purposes,” said Fardone.

“Without TFE, this would equate to a notional deduction of $20,000 and an R&D incentive of $3,700 (i.e. 18.5 per cent of $20,000). With TFE, however, this notional deduction increases to $100,000 and equates to an R&D incentive of $18,500 (i.e. 18.5 per cent of $100,000) – a massive $14,800 cash difference.”

She added that BDO was able to assist businesses with the process in claiming the R&D Tax Incentive.

“What me and my team do is meet with companies, talk to them about their R&D activities, help them to prepare those project descriptions,” she said.

“It’s a very nuanced area – there are a lot of little rules here and there especially when it comes to the expenditure side at the moment and ATO reviews.”

But businesses have just over a month to make the claim.

“If you miss the deadline, you miss the deadline,” Fardone said.

“But it’s not like a competitive grants process – it’s an entitlement programme. So if you tick the eligibility boxes, you are entitled to receive this benefit.”