Long term trends in the Australian exploration sector

Sherif Andrawes, Partner and BDO’s Global and National Head of Natural Resources, gives a sneak preview of the long-term trends of the Australian exploration sector before the final report is released next month.

Every quarter since June 2013, BDO has analysed the financial health of the Australian exploration sector based on cash flow data from Appendix 5B reports lodged with the Australian Securities Exchange (ASX) by listed exploration companies.

“The June quarter of 2023 marks the 10th year anniversary of the analysis of this data, and over the course of this period, we have had the privilege of witnessing how the sector has grown and evolved against the wider backdrop of the business cycle, capital market movements, geopolitical events and trends in commodity markets,” Andrawes said.

“Cash, as we know, is the lifeblood of exploration companies. Our quarterly analysis has always sought to understand how cash is moving in and out of the sector, and aims to answer questions such as, ‘how much cash is being raised?’, ‘by whom?’ and ‘how is it being spent?’”

The full preview includes trends surrounding the number of companies involved in the sector and exploration expenditure. Here Andrawes contentrates on cash balances and financing cash flows.

Cash balances

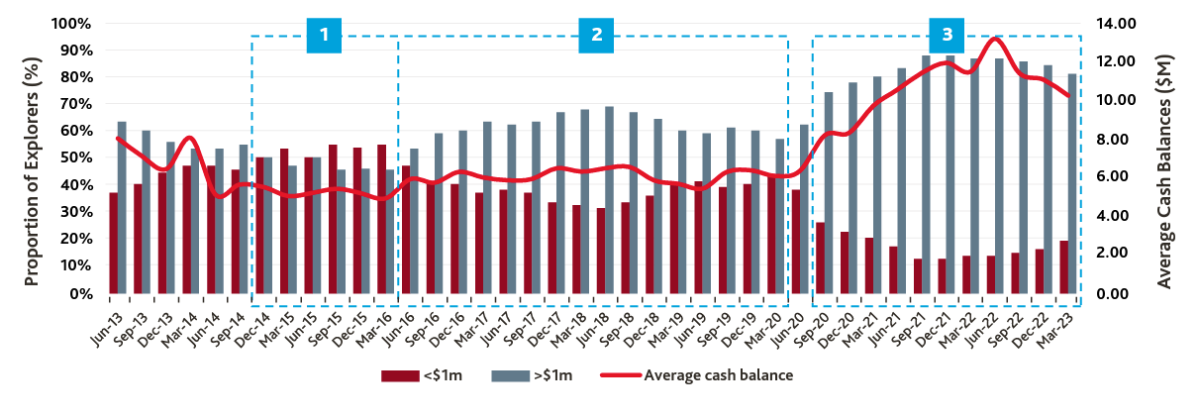

Cash is the lifeblood of exploration companies. The long-term graph below outlines the proportion of exploration companies with cash balances of more (or less) than $1 million, as well as the average cash balance per company. The broad trend shows just how unprecedented the cash position of the exploration sector has been in recent quarters, following the surge of funds into the sector post June 2020, resulting in explorers truly being ‘cashed-up’.

Back in June 2013, 63 per cent of exploration companies reported a cash balance of more than $1 million, which represented a decent majority.

However, in light of challenging market conditions for ASX listed exploration companies, funds seemed to flow towards other sectors, which resulted in a cash burn that left more explorers with less than $1 million in the bank by March 2015. During this period, average cash balances also reduced and averaged $5.21 million from June 2014 to March 2016.

June 2016 reflected an increase in financing with the majority of companies having more than $1 million in the bank again. However, growth in average cash balances remained subdued, largely due to stronger exploration activity having an offset effect on newly raised funds.

Then, in September 2020, post-COVID 19 financing spiked and so did cash balances. Both average cash balances and the proportion of companies with $1 million and above continued to increase as companies took advantage of the favourable capital markets to raise funds, whilst withholding from undertaking large spends due to residual economic uncertainty. However, this trend has started to taper off in the last three quarters to March 2023 as capital markets have since cooled whilst strong levels of exploration spending persist.

Although some explorers have started to enter into cash preservation mode amidst current economic uncertainty and high interest rates, a look back on the last ten years of data shows explorers are still cashed-up like never before.

Financing cash flows

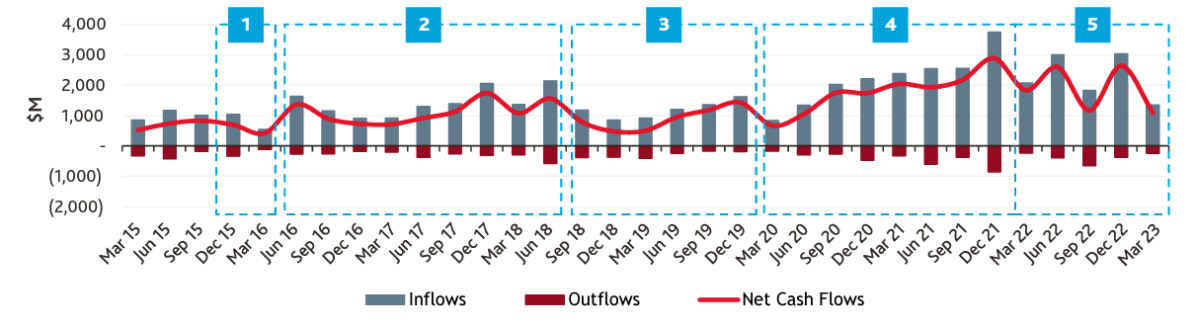

Although our analysis commenced in June 2013, specific financing inflow and outflow data was only tracked starting from March 2015 quarter.

At the time, the sector comprised 793 companies that raised a total of $847 million. Financing inflows then averaged $1.0 billion over the four quarters to December 2015 before contracting by 48 per cent in March 2016 driven by low commodity prices and low demand for commodities.

Inflows then bounced back and exhibited an increasing trend across mid-2016 to 2017, primarily driven by funding into gold, oil and gas and lithium companies. In particular, a growth in investment into gold as a safe-haven asset followed the announcement of Britain’s proposed exit from the European Union (Brexit) as well as the US Presidential election of 2016, which contributed to significant uncertainty in global markets.

Financing remained strong to mid-2018, before decreasing by 45 per cent in September 2018. This was caused by volatile capital markets underpinned by concerns surrounding global trade tensions and rising interest rates.

These conditions continued to weigh on the sector, albeit at a diminishing rate as financing inflows gradually climbed each quarter to December 2019.

Then, financing inflows plummeted 48 per cent to a four-year low of $834 million in the March 2020 quarter. This was of course driven by the plunge in global financial markets due to the emergence of the COVID-19 pandemic.

At the time, the outlook for the sector was extremely uncertain and we saw a temporary pause in all financing, investing and operational activities.

However, low interest rates coupled with government stimulus into the Australian economy saw investors turn their attention to equities, and we started to see both retail and institutional investors pouring funds into the exploration sector (especially for IPOs) in pursuit of better returns.

Markets bounced back and financing inflows reached historical levels as the world recovered from the effects of the pandemic. In the December 2021 quarter, financing inflows peaked to $3.75 billion, which is the highest we have seen since.

Financing cash flows were more volatile over 2022 and now to March 2023. Rising interest rates, inflation and geopolitical events like Russia’s invasion of Ukraine led to much more turbulent market conditions, and although funds are still flowing into the sector in waves, we observe that this is primarily for more advanced development projects, particularly for battery metals and energy transition commodities.