Winners and Losers: Biotech LBT Innovations triples in value

In the space of just five days, shares in biotech LBT Innovations jumped up by 220 per cent.

The APAS Independence instrument scans the contents of petri dishes for bacterial colonies from medical samples. Image: LBT Innovations

The company’s securities more than tripled over the week to hit a share price of 1.6 cents per share, but stocks remain down 55.62 per cent on this time one year ago.

LBT Innovations’ market cap rose in turn too, hitting $15 million at the close of trade on 1 December following a busy week for the microbiology automation group.

Headquartered in Adelaide’s CBD off Waymouth Street, LBT uses artificial intelligence in a bid to accelerate advancements in the microbiology space. The company this week hosted its annual general meeting and highlighted its growing sales pipeline to shareholders.

Its jump to number one in the Winners list this week followed a recent financial reset when the company raised $3.6 million at 0.5 cents per share in October.

LBT also presented alongside industry peers at an Australia Pharmaceutical conference in Melbourne last week where its APAS PharmaQC technology was selected as a case study for AI applications within the regulated pharmaceutical manufacturing market.

“We have led the way in the application of artificial intelligence technology for clinical microbiology and remain one of only five devices using artificial intelligence to obtain clearance by the US FDA in this field,” LBT quality and regulatory director Julie Winson said.

“The systems and processes we have developed for our clinical product are a key differentiator for our technology and enable us to collect the data we require to demonstrate the performance of APAS PharmaQC in pharmaceutical environmental monitoring.”

Unico Silver also landed in the top five Winners of the week despite making no new announcements.

Baker Young analysts said the emerging silver company rallied on healthy volume sentiment around a peak in both US interest rates and strong weekly gains in silver and gold stocks driven by the US dollar.

Terramin, Investigator Resources and Sparc Tech all made the top five Winners too in a week where markets rallied on expectations rates have peaked as inflation continues to ease around the globe. The S&P ASX/200 rose 5 per cent in November – its strongest monthly gain since January’s 6.2 per cent rally.

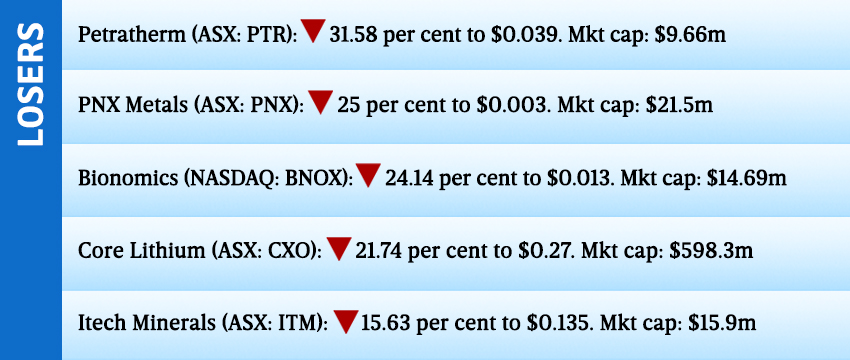

As for the Losers, Petratherm topped the list this week on news that drilling has been completed at one of its major sites, with drill cores sent to Adelaide for tests and analysis.

“Whilst no visible mineralisation or significant alteration is evident from the initial field logging, we believe we are in the right geological address on the Mabel Creek Project,” Petratherm CEO Peter Reid said.

Core Lithium was another Loser this week as lithium prices dipped to fresh lows with lower electric vehicle sales and price cuts by auto manufacturers weighing on demand for the mineral.

The full list of Winners and Losers for the week ending 1 December:

Data compiled by Baker Young Limited. Accurate as of close of market 1 December.