Winners and Losers: Rough seas for fish farmer in $9.5m raise

Clean Seas was one of the week’s biggest Losers but completed a $9.5 million raise and announced an operational review of the business on Friday.

Clean Seas kingfish pens in Spencer Gulf. Photo: Supplied.

The company, which breeds and sells Spencer Gulf kingfish and South Australian yellowtail, was the number two Loser of the week.

Shares in Clean Seas fell 27.40 per cent over the five days, two of which it spent in a trading halt ahead of the announcement of a $9.5 million capital raise on Friday.

Funds will be used for headroom to support working capital and costs related to a newly announced operational review which will be implemented over the next three to six months.

That review will see the company reassess the biomass levels and optimal production volume at which the company should operate, the consolidation of farming activities, and “right sizing the business” to maximise profitability and cash flow.

Clean Seas said the decision to review its operations was made in response to constrained supply of fish meal and fish oil resulting in “significant” increases in feed prices, an increase in competitive pressure across domestic and international markets, and “a shift in general market conditions”.

“The board and management team have given considerable thought and focus to the optimal future structure for the Clean Seas business,” chairman Travis Dillon said.

“While achieving the right balance of growth and profitability is a sensitive one in an aquaculture business that has significant operational risk, it is clear that the Clean Seas business model requires change to navigate the current challenges.”

The top Loser of the week was Magnetite Mines which recently conducted a rights issue raising $6.5 million, slightly above the company’s $6.2 million target which Baker Young Limited analysts told InDaily represented “strong support” from shareholders and directors.

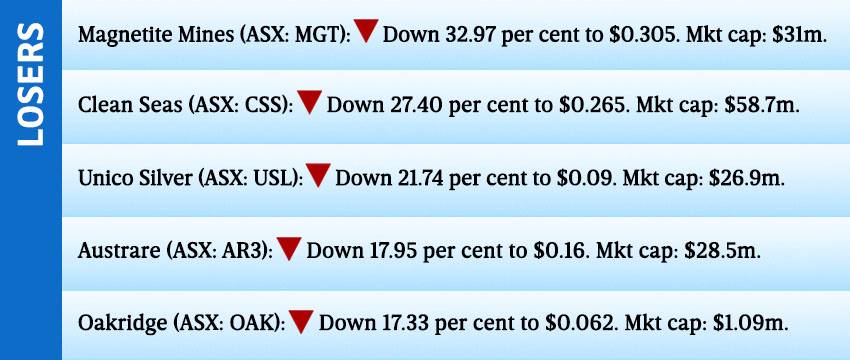

The remainder of the Losers included Unico Silver, Austrare and Oakridge.

The biggest gainer of the week was Petratherm which made no announcements during the week. It was followed by Boart Longyear and Argonaut Resources.

Elixir Energy also made the top five Winners of the week and provided an update on the drilling of an appraisal well in its Grandis gas project.

“The drilling of Daydream-2 continues to go very well and we are on track to meet our estimate of around one month to get to total depth,” Elixir managing director Neil Young said.

“This week we successfully obtained logs for Origin Energy for its carbon capture and storage project in the region – demonstrating the emerging ‘Energy Super Basin’ that we consider the Taroom Trough will become.”

1414 Degrees rounded out the top five for the week, after two small trades pushed the small-cap up 9 per cent. The company’s shares were down 31.42 per cent compared to this time last year.

The full list of Winners and Losers for the week ending 24 November:

Data compiled by Baker Young Limited.