Increase GST rather than change tax on super, expert says

Calls by the Grattan Institute to cut superannuation contribution caps and tax all superannuation pension payments have been questioned by experts, who say more comprehensive tax reform would be better.

Superannuation tax change proposals are aimed at the wealthy. Photo: Getty

Grattan’s report says super tax breaks cost the budget up to $45 billion and they could cost more than the age pension by as soon as 2036.

A range of measures put forward by the think tank are claimed to reduce super costs by $11.5 billion to $13.5 billion, to be raised from the top 1 per cent of super balances.

The savings measures include the cutting of annual concessional contributions to $20,000 from $27,500 and cutting non-concessional contributions to $50,000 from $110,000.

Although the proposals would reduce expenditures, a better approach would be to conduct a wider tax reform, said Professor Mark Crosby from Monash University Business School.

See the big picture

“I think it’s very misleading to talk about the costs of superannuation tax breaks alone,” Professor Crosby said.

Introducing the contribution and payment reductions would be unfair in the current environment.

“People have been contributing money for many years to save for retirement. They have paid a lot of tax because income tax rates have been high,” he said.

For those people to move into retirement with the expectation that they would have current super tax rates and to have them changed would throw into question the reliability of the super system.

“I think that would be quite unfair.”

Professor Crosby said a better way forward would be to restructure the whole tax system with a greater reliance on consumption taxes.

“As the population ages we are going to have to have higher income taxes to pay for the low taxes the government will receive from older people.”

He said Australia has a tax system that relies more on income taxes than most OECD countries and there would be advantages in changing that.

“It’s unfair to have a system that relies very heavily on indirect taxes.”

That is because as the population ages, older people will pay less taxes but continue to spend, pushing more of the tax burden onto younger people.

So rather than focus on increasing superannuation taxes, the better option would be to change the tax make up.

“I know it’s politically difficult, but it makes more sense to raise the GST so you would still be getting income from people in retirement and building a better tax system,” Professor Crosby said.

The cost of superannuation benefits is rising in the budget, but super is gradually reducing the cost of the age pension as more retirees become fully or partly self-funded.

Age pension use declining relatively

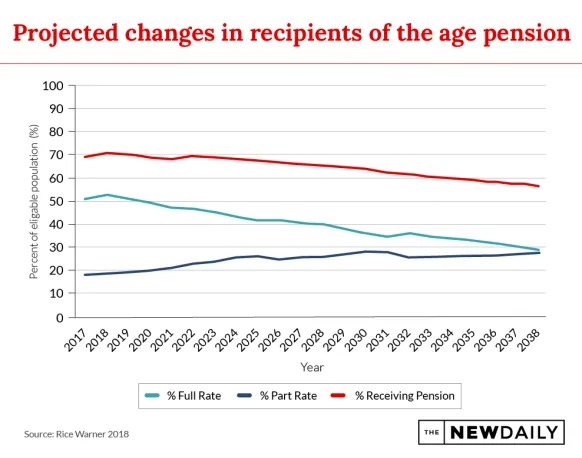

Quoting a 2018 report by Michael Rice, National Seniors chief advocate Ian Henschke said it showed the relative cost of the age pension is falling.

“The report said pension expenditure was around 2.7 per cent of GDP and it will keep falling in future.”

The Rice report said it would fall to 2.5 per cent of GDP by 2038.

“In other words, rather than the age pension costing more in future, even with an ageing population it will cost less,” Henschke said.

“Our superannuation system is reducing pension costs as more and more people turn pension age and have so much in super savings.”

As super grows, more people will be ineligible for the pension and many more will have only part-pension eligibility.

“So, in any discussion about the cost of super you must counterbalance that with the pension savings,” Henschke said.

Equity grounds important

However, independent economist Saul Eslake said the Grattan proposal would be useful on equity grounds.

“It is a way of reducing the extent of tax concessions that go to people who make large voluntary contributions and reduce the use of super as a vehicle for reducing the tax on investment as distinct from accumulating retirement income,” Eslake said.

Grattan economic policy program director Brendan Coates, an author of the report, said the recommendations would “have almost no impact on age pension spending because each of the measures overwhelmingly affect the tax breaks of the wealthiest 20 per cent of Australians”.

That demographic tends not to qualify for any age pension.

“Even taxing all super earnings at 15 per cent which will raise $5.3 billion a year or more – of that only 5 per cent will be raised from the poorest half of all retirees,” Coates said.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings.