Leigh Creek capital raise to fuel syngas project

Leigh Creek Energy has raised $18 million which it says will allow it to begin construction of its commercial syngas and power generation project in South Australia’s Far North.

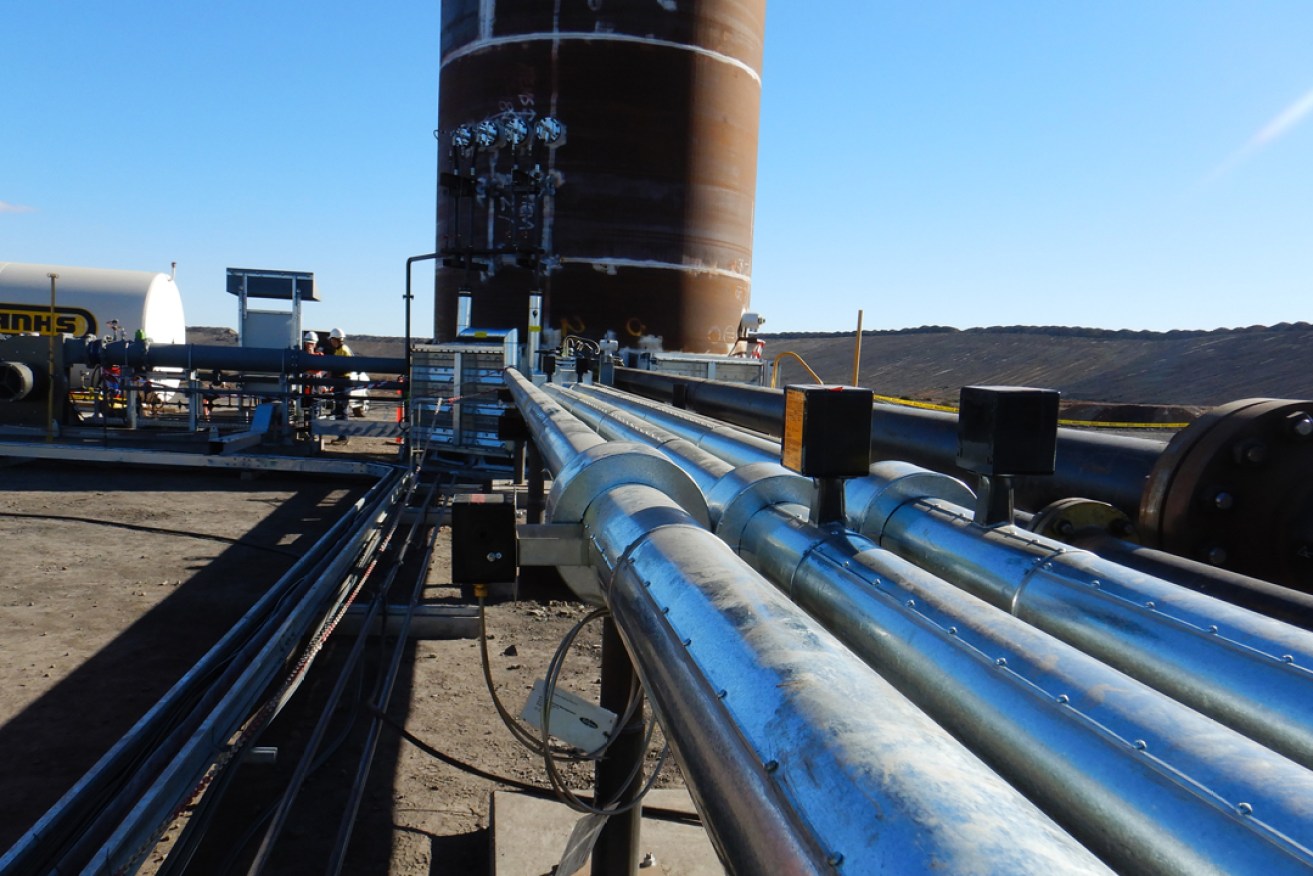

The thermal oxidiser, gathering pipes and fuel tank at Leigh Creek Energy's test site 550km north of Adelaide.

The project, 550km north of Adelaide, aims to become the largest underground coal gasification site in Australia and a globally significant producer of nitrogen-based fertiliser for agriculture.

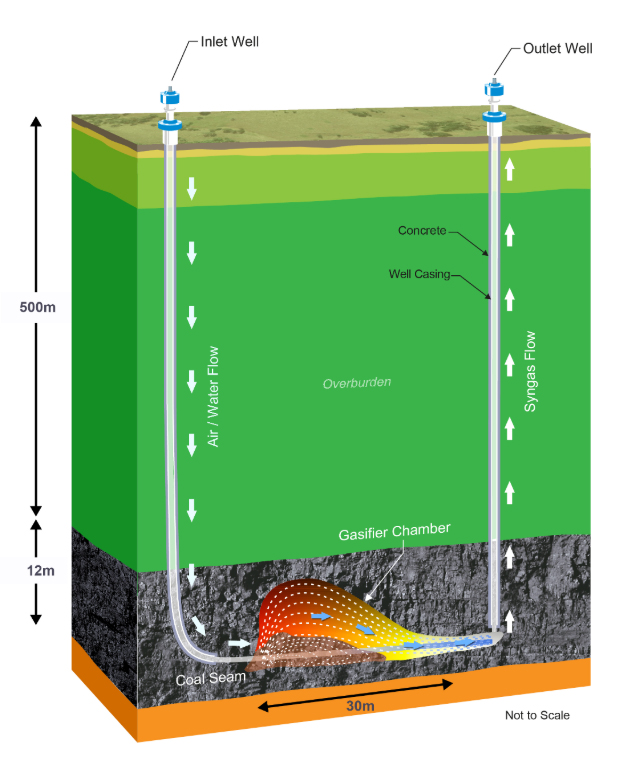

It will use unconventional technology – banned in Queensland and Scotland – to extract syngas from beneath the ground at the former coalfield. Syngas is a mixture of carbon monoxide, carbon dioxide, methane, hydrogen and other elements.

The $18 million will fund Stage 1 of the project will advance the project towards the commercial production of syngas to initially be used to create power that can be sold on the national grid.

The funds will pay for the acquisition of 3D Seismic surveys ($1 million), the drilling and construction of gasifier chambers ($6.5 million), acquisition of power generation infrastructure ($6 million) and general working capital ($5 million).

The power generator acquisition will begin almost immediately, the 3D survey completed in October and the drilling of wells will start in the December quarter while the 5MW power plant is expected to be constructed by the end of March 2022.

How coal gasification works. Image courtesy of Leigh Creek Energy.

Leigh Creek Energy plans to eventually use syngas to produce one million tonnes of nitrogen-based fertiliser a year to supply Australian agriculture. It projects revenues of $26.5 billion and costs of $8.1 billion over the 30-year commercial lifespan of the project.

The larger Stage 2 part of the $2.6 billion project involves increasing gas production, a larger power plant and the construction of the processing plant to convert syngas into urea fertiliser with the potential to couble production to 2Mtpa.

A definitive feasibility study on Stage 2 of the project is due to be completed by the end of the year.

Leigh Creek Energy managing director Phil Staveley said the capital raise would allow the company to focus all of its resources on driving forward the commercial stages of the project.

“This $18 million capital injection will enable LCK to continue to move forward with Stage 1 of our flagship project with added confidence and puts us one step closer to our goal of building a plant at Leigh Creek which can deliver urea into the Australian and overseas market,” he said.

The company last month struck an agreement with South Korean engineering and construction giant DL E&C Co to become the commissioning contractor for the engineering, procurement and construction of the flagship project.

“In the coming weeks we expect to execute the final agreement for engineering, procurement, construction and completion of the urea plant with Korean giant DL E&C and offer further equity to our existing. Loyal shareholders,” Staveley said.

The $18 million capital raise was supported by several Australian and global institutions.

The placement will be issued at $0.18 per share, which represents a 20 per cent discount on the price of $0.225 on Thursday when it was placed in a trading halt.

Leigh Creek Energy was granted a petroleum production licence to commence commercial syngas production by the SA Government in November.

Leigh Creek Energy holds two permits over the now-closed Leigh Creek coalfield. The site has gas reserves of 1153 petajoules (PJ) plus indicated and inferred coal resources of 301.2Mt.

One of the two permit sites includes 654 PJ of gas reserves, which the company says is sufficient to supply the proposed 1Mtpa urea production facility for 20 years.