Iluka mothballs SA mine despite profit

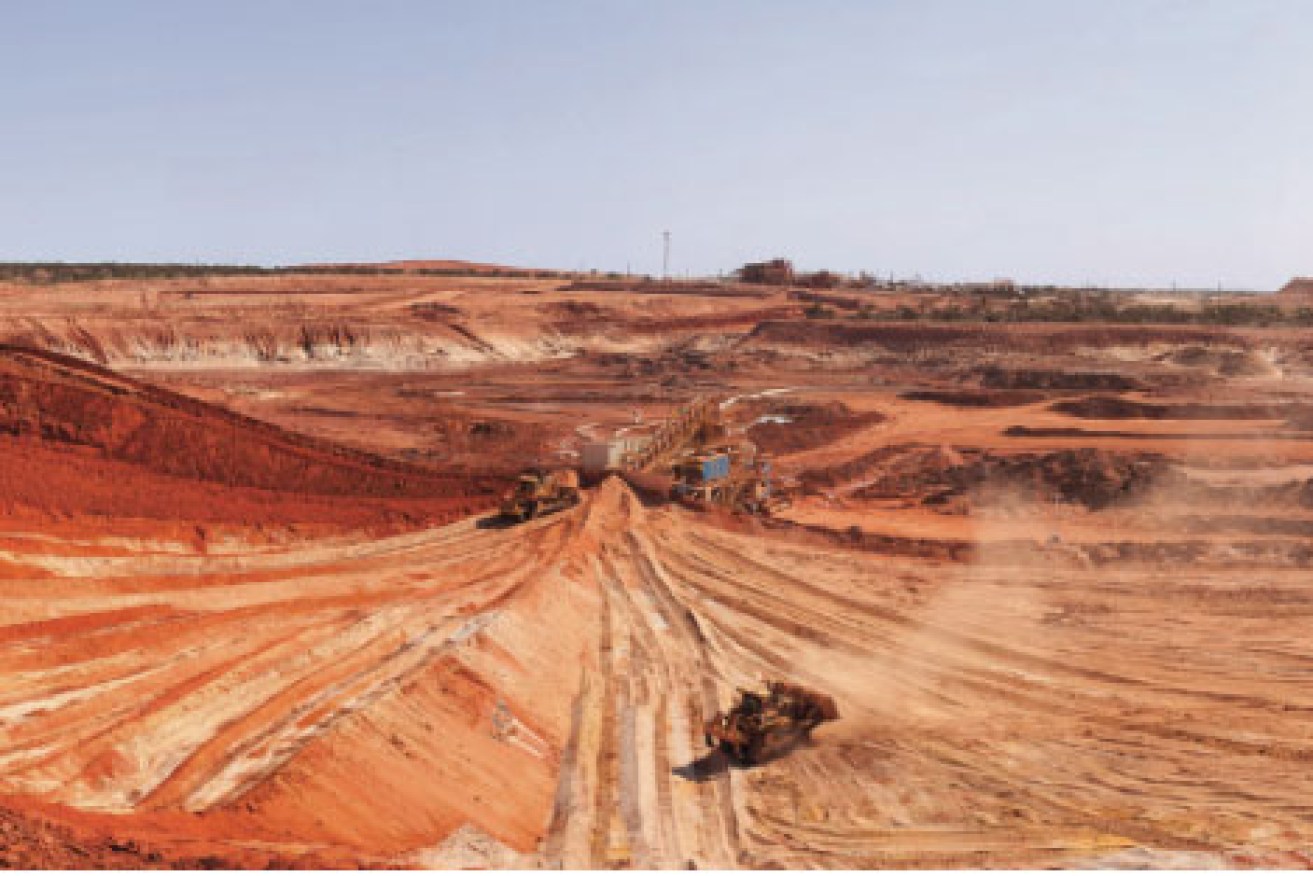

Iluka Resources has reported a profitable 2015 despite plans to mothball its South Australian operation Jacinth-Ambrosia for up to two years.

Releasing its full-year financials for 2015 to the ASX on Friday morning, the company has ended the year with no debt, its business generating free cash flow and returned dividends to shareholders.

Iluka reported that revenue was up 13.1 per cent to $819 million and its reported earnings were $53.5 million with earnings per share of 12.8 cents from 15 cents in 2014.

The miner touched on its plans to mothball the mineral sands mine, 290km from Ceduna on South Australia’s Eyre Peninsula.

“There will be no heavy mineral concentrate (HMC) production in Murray Basin and the US, and HMC production will be suspended at Jacinth-Ambrosia from 16 April 2016,” it announced.

“As a result, HMC inventory will be drawn down during 2016 as it is processed into finished products through the mineral separation plants and not replenished from mining.”

The Jacinth-Ambrosia mine began in 2009 and is believed to have the highest-quality zircon source in the world.

The closure sees 33 jobs cut and contractors will be reduced but more than 40 positions are expected to be retained at the mine site during its hiatus.

However, managing director David Robb said resting the SA operations would be financially rewarding during “subdued” times.

“Earlier this week the company announced its intention to suspend mining and concentrating operations at Jacinth-Ambrosia for a period of 18 to 24 months,” he said.

“The suspension will increase the company’s free cash flow at a time of subdued industry returns.

“It will also improve return on capital over time by reduction operating costs and accelerating inventory drawdown – therefore reducing working capital.

“In addition to the extend that perceptions of an inventory supply overhang might impact market pricing dynamics, then Iluka believes its contribution to a reduction in global inventory will impact those dynamics positively.”

Robb said the company had the right balance of maintaining “defensive strength” in the current resources climate and creating options for “the industry of the future”.

“I am confident the company is well positioned in both aspects.”

Robb said Iluka’s approach over 2015 had been consistent with previous years and remained centred on shareholder returns.

“Specifically, Iluka’s business was managed to achieve a balance between positioning the company conservatively and robustly against prevailing in global economic conditions while being prepared to invest in options which position the business for demand recovery and future growth.”

Iluka reported a free cash flow of $155 million and net cash at year-end was $6 million compared to $59 million debt at 31 December 2014; net cash at end of January was $24 million.

It returned a final dividend of 19 cents; full-year dividend of 25 cents in 2015 – 100 per cent franked (2014 – 19 cents).

Iluka Resources was trading at 6.87 at 10.17am (AEDT)