Uni merger in ‘unacceptable risk position’ without taxpayer funding

Creating a new Adelaide University will require a one-off investment between $500m and $650m, the two merger universities forecast, amid questions over whether taxpayers already committing $444m will have to pay more for any cost blowout.

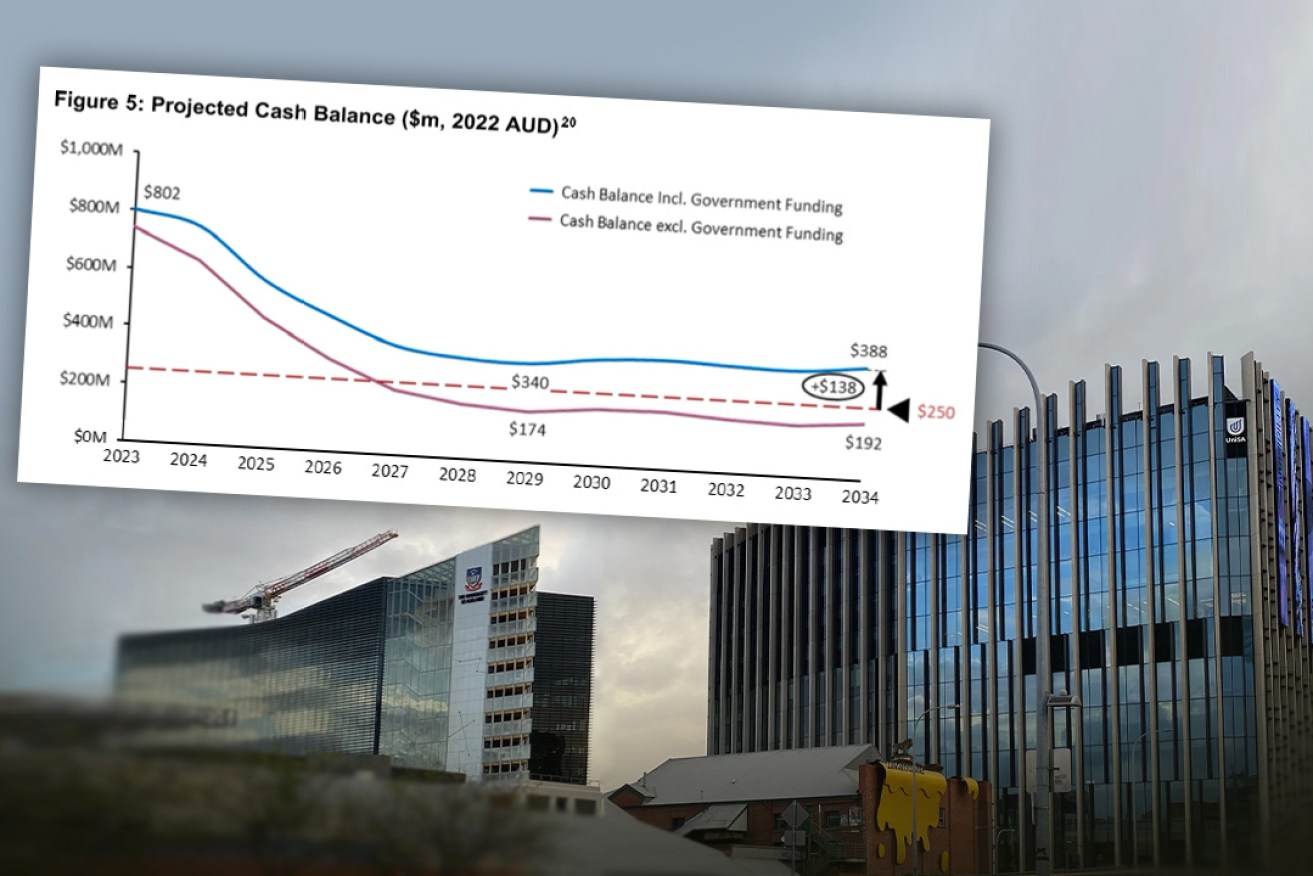

The transition costs required to create a new university will require dwindling the two universities' combined cash balance from $802m in 2023 to $340m by 2029, according to financial projections released by the two universities this week. Photo: Tony Lewis/InDaily; graph: summary business case.

The University of Adelaide and University of South Australia on Tuesday provided a 28-page “comprehensive summary” of its merger business case to the parliamentary inquiry into the establishment of Adelaide University.

The summary business case which excludes “commercial in confidence” information forecasts that $430m in “one-off investment costs” will need to be spent from 2024 to 2026 to allow the new Adelaide University to open in January 2026.

That’s part of a total $500m to $650m projected spend required between 2023 to 2030, and does not include a further $62m per year in ongoing costs.

The merger investment will require the two universities to dwindle their combined cash balance from $802m in 2023 to $340m by 2029, according to the summary business case.

UniSA vice-chancellor David Lloyd told the parliamentary inquiry on Tuesday that the merger would put the universities in an “unacceptable risk position” if it wasn’t for the Malinauskas Government committing $444.5m in taxpayer funding.

The funding comes via $300m in perpetual funds, $114.5m in land acquisitions and $30m for measures to attract international students.

“We are reliant on those perpetual funds to underpin our delivery of the transition and the transformation, but also direct investments through the acquisition of the land,” Lloyd said.

“Without that support from the government, I think in the documentation we provided to members today you will see that it moves into an unacceptable risk position for us.

“That’s why we are requiring the engagement of the government in that regard.”

Without the state government’s funding support, the summary business case projects that the new university’s cash balance would drop to $174m by 2029 – below a liquidity floor of $250m set by the universities.

Adelaide University’s projected cash balance (with and without government funding) as the merger progresses. Source: summary business case

The majority of the universities’ projected investment – $314m – will go towards workforce integration, asset integration, IT integration, branding and marketing, and “other transition costs” such as stakeholder engagement, change management, program management and transition delivery.

A further $136m has been earmarked for curriculum development, academic workforce recruitment and infrastructure investment.

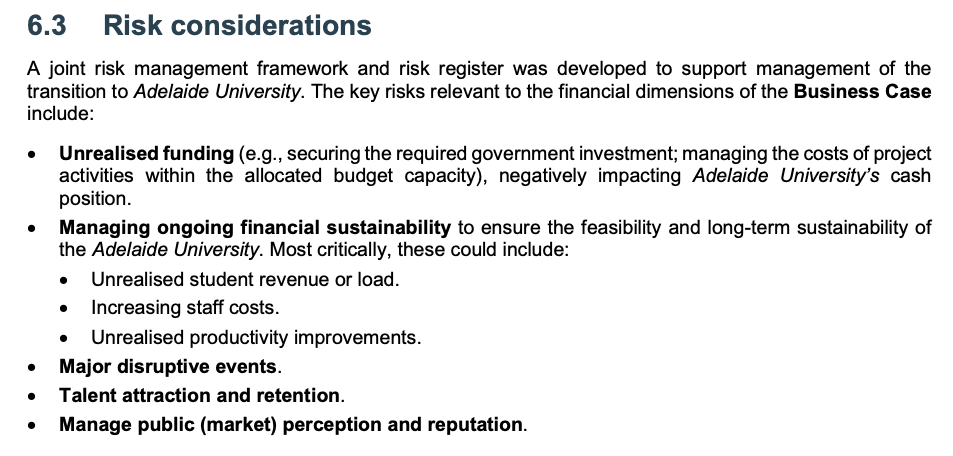

Despite the huge investment, only a quarter page – or just over 100 words – are dedicated to “risk considerations” in the summary business case provided to the committee.

The section names some potential risks, such as unrealised funding, major disruptive events and managing market perception, but does not provide any detail.

A footnote in the section states the universities’ governing councils considered a “risk register” to inform their decision on whether to progress with a merger.

The section of the summary business case detailing the university’s risk considerations.

Opposition education spokesperson John Gardner on Tuesday questioned the lack of risk assessment and mitigation information provided to the committee.

He said it was particularly significant given the state government’s higher education unit has not done a risk assessment of the university merger, nor asked for the universities’ full business case.

“I am much less worried about the risk of the government’s financial investments than I am about the risks of adverse consequences of the plan not working in the way that is being described and envisaged,” Gardner told the vice-chancellors.

“A risk register presumably suggests that there have been risks considered and mitigation strategies put in place by the universities but we don’t have any of that information in front of us.

“The reason why to my mind that’s so important is that the evidence from the government’s higher education unit last week was that they haven’t done any detailed risk assessment, risk analysis.

“So their analysis relies very heavily on this document that is summarised in eight lines in the information that we have.”

Lloyd replied that the universities would be open to providing the committee more information about the risk considerations, provided it’s in confidence.

“Rest assured there is a voluminous risk assessment which accompanies this documentation, and indeed the consideration of the councils was through a lens of risk not only to their own institutions but for the concept of the future institution as well,” he said.

“That document hasn’t been provided because it actually contains a significant amount of information about how we are going to mitigate the risks and the intellectual property involved in that mitigation directly underpins our competitiveness in terms of the national landscape.

“So if we are able to arrange a mechanism by which we can disclose that in camera, in confidence, we will be happy to do that.”

Gardner, whose party is yet to decide whether they will support the government’s legislation to establish a new university, also questioned the vice-chancellors on who would pay if merger costs spiral.

“I guess the key thing is, can you rule out South Australian taxpayers being forced to step in to provide adequate funding if these risks aren’t adequately mitigated?” Gardner asked.

University of Adelaide vice-chancellor Peter Høj replied: “Maybe what we can say is if you want to look at future performance it’s probably instructive to look at past track records.

“These two institutions managed to weather the COVID storm enormously well.

“These two institutions would be in the minority of institutions that have managed to eliminate their respective debts and, at the same time, have built up a cash position despite their relatively small sizes by Australian standards to be able to co-contribute very substantially to the formation of a new university.

“If there were another pandemic, if there were another black swan moment, could we guarantee you that we would just sail through again? No, we couldn’t.

“But should you trust that if anybody could do it, it would be us? Yes, on past performance, you should.”

Lloyd added that the information provided to the universities’ finance committees modelled for a “catastrophic black swan event” and “we know how to mitigate those events based on past performance”.

A full copy of the summary business case provided by the universities can be found below.

The joint committee inquiry has a deadline to report back on October 17 as the Malinauskas Government wants to pass the legislation required to establish the new Adelaide University before the end of the year.

The merger inquiry resumes public hearings on September 4.

Loading…