Listings influx weighs on home price recovery

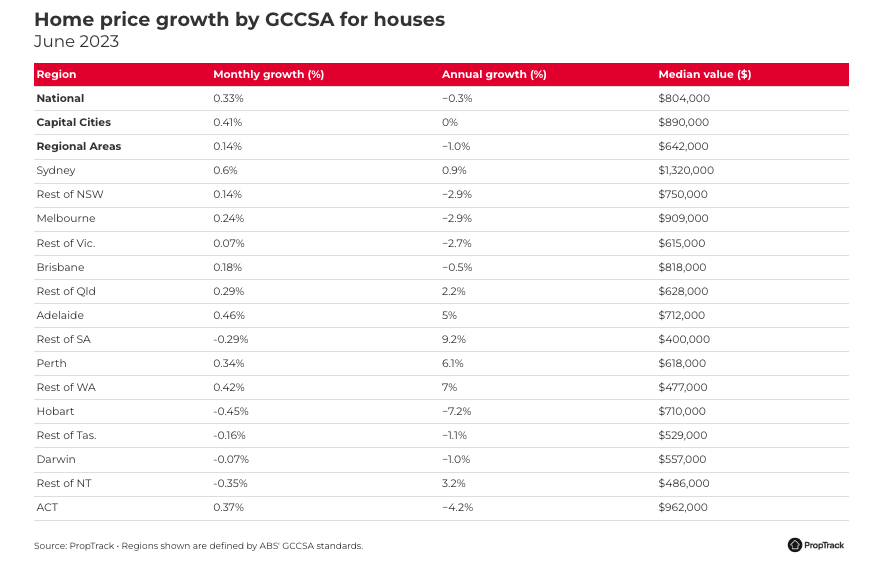

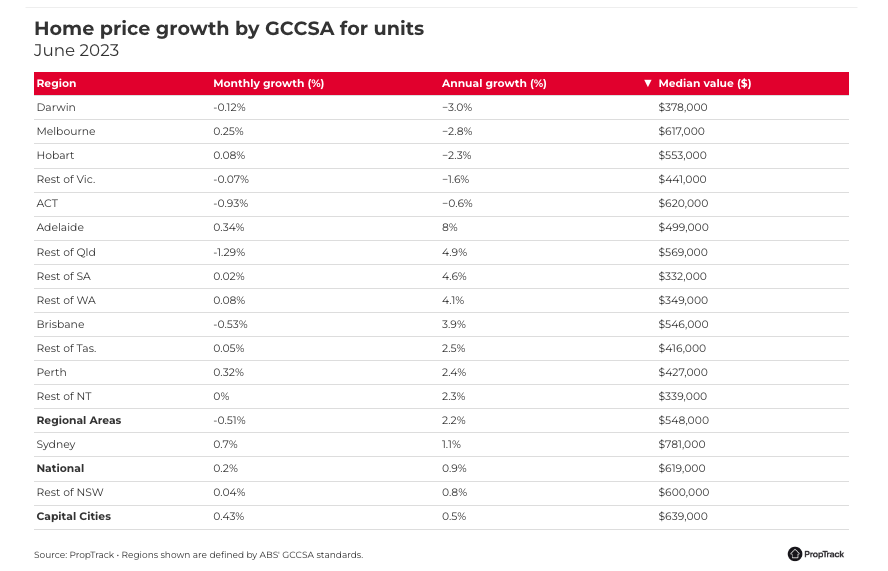

Adelaide home price growth tops the nation, but the pace has eased a little due to a seasonally unusual lift in homes for sale.

The latest figures show Adelaide leading home price growth across Australia, especially for units. Photo: AAP

An injection of new listings has taken some of the sting out of the housing market upswing as buyers find themselves with more to choose from, but the price of residential properties, especially units, continues to rise in Adelaide and across South Australia.

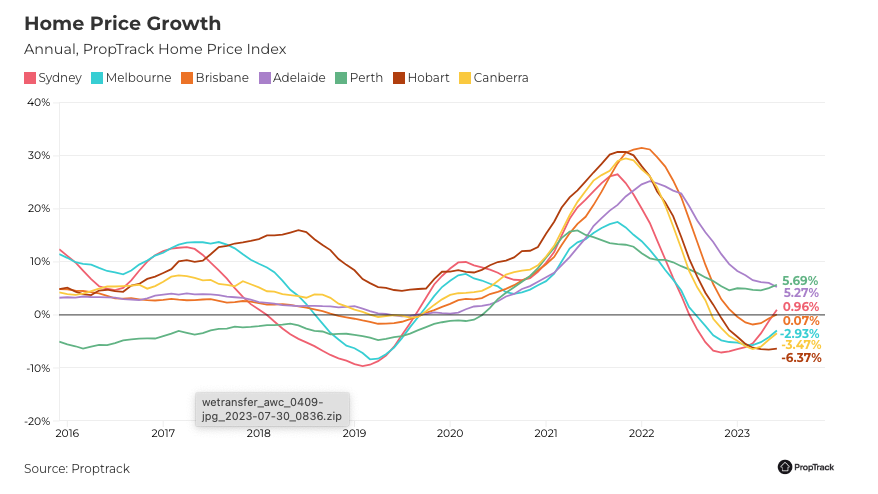

PropTrack’s property price index, released on today, has been climbing for seven months in a row.

The index has nearly fully reversed its decline, lifting 2.79 per cent from its December lows.

PropTrack senior economist Eleanor Creagh said that while the full impact of rate rises was yet to be felt and remained a headwind for a property market rebound, she was optimistic about growth.

“However, interest rates are nearing their peak, if not there already,” she said.

“This is likely to sustain confidence and maintain the lift in home prices, resulting in more markets returning to positive annual price growth.”

Creagh said many people had managed to get ahead on their mortgage repayments during the pandemic and most households were employed, which would keep a lid on distressed sales.

Refinancing, which has boomed since interest rates started rising, would also provide some reprieve, she added.

Nerida Conisbee, Chief Economist at the Ray White Group agreed with Creagh and said there are a lot of push and pull factors in house prices at the moment.

“Interest rate rises may not be over and we are seeing more stock coming to market,” Conisbee said.

“Anecdotally, more investors are selling, driven out of the market by higher interest rates and a more difficult ownership environment in many states.”

She said that rental growth is also starting to slow for houses across Australia, but remains strong for apartments, especially in Adelaide.

“One positive about the growth, particularly in apartments, is that it is likely making more new projects viable,” Conisbee said.

“This will ensure greater housing supply over the next two years.”

CoreLogic’s figures, also released today, found housing values have continued to rebound following the downturn sparked last year when interest rates started going up, albeit at a slower monthly pace.

CoreLogic’s national home value index rose 0.7 per cent in July – ascending for the fifth month in a row – but the monthly lift was down from 1.1 per cent growth in June and 1.2 per cent in May.

Markets are still trending up in most regions and cities but at a slower pace, with Sydney nearly halving its pace of growth since May.

CoreLogic research director Tim Lawless said the Sydney market, which had been leading the upswing, had been flooded by a not insignificant number of new listings.

“An increased flow of new listings provides more choice and may be working to reduce some of the urgency felt among prospective buyers,” he said.

Listings in the NSW capital were up 9.9 per cent compared to the same time last year and 18 per cent above the previous five-year average.

While new listings have been trending higher, overall capital city levels are still well below five-year averages.

Lawless offered a couple of reasons why sellers might be more active than usual.

Sellers may have jumped on what they expected would be a slower winter period to list before spring, when stock levels tend to pick up and create more competition between vendors.

“Another possibility is that we are seeing the first signs of motivated selling as the rapid rate hiking cycle catches up with household balance sheets,” Lawless said.

The housing expert expects mortgage arrears to lift through the second half of the year but believes it’s unlikely to become widespread, with a relatively strong labour market likely to support most households to meet their repayments.

– with AAP