‘Moral duty’: Bank closures anger SA towns

Dozens of bank branches shutting across regional South Australia have impacted older residents, exposed local businesses to security risks and eroded confidence, councils have told a federal inquiry – as community backlash prompted one bank to reverse its planned closure of a Limestone Coast branch.

The closed Westpac branch in Coober Pedy. The nearest branch is now more than 500km away in Port Augusta. Photo: Google Maps

More than 400 individuals and organisations have made a submission to a federal Senate inquiry into bank closures in regional Australia, amid concern about a growing number of face-to-face bank branch closures in regional communities.

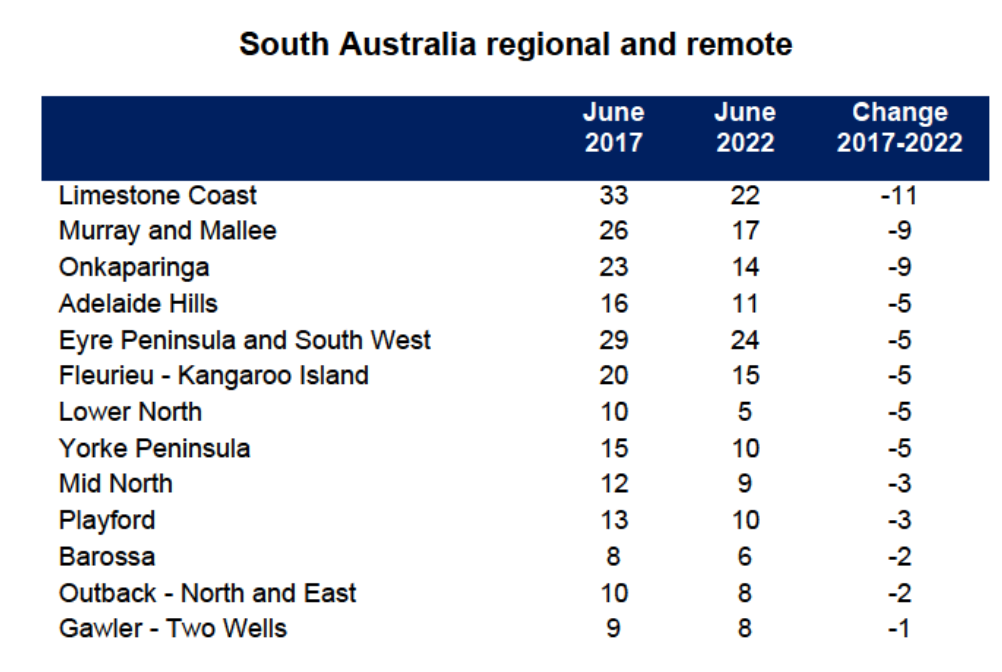

Australian Prudential Regulation Authority data shows the number of bank branches in South Australia (including metropolitan Adelaide) dropped from 421 in June 2017 to 294 in June 2022 – a reduction of 127.

Over that period, Limestone Coast branch numbers dropped from 33 to 22, in the Murray and Mallee from 26 to 17, in the Eyre Peninsula and South West from 29 to 24, and from 20 to 15 on the Fleurieu and Kangaroo Island.

There have also been declines in the Lower North (10 to 5), Yorke Peninsula (15 to 10) and Mid North (12 to 9).

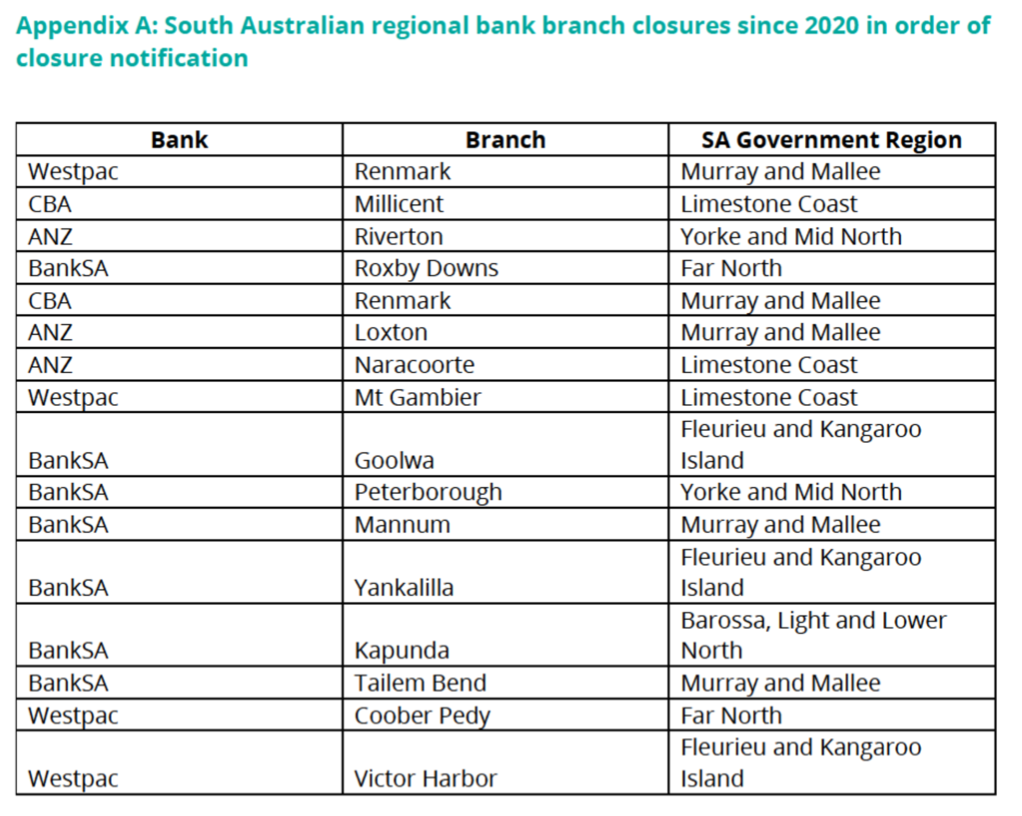

A list of regional bank closures in South Australia since 2020. Table: SA Govt

The state government submitted that an average of 3.5 regional branches have been closing across South Australia every year since 1975.

It said the number regional branches in South Australia has decreased from 228 in 1975 to 67 in 2021, citing data from The Regional news website.

Kingston District Council, which takes in Kingston SE and Cape Jaffa in the upper Limestone Coast, says residents were left in shock when it was announced last September that BankSA would close its branch in Kingston SE.

Westpac, BankSA’s parent company, put the branch’s closure on hold in February amid backlash during the Senate inquiry.

On Monday, BankSA told Kingston District Council that it would now keep the branch open following “discussions with our customers and community leaders”.

Council CEO Nat Traeger said the community was “thrilled that BankSA have seen fit to over-turn their decision”.

“We thank the decision makers for hearing our voice and placing an importance on the future of regional banking in Australia,” she said.

Traeger said BankSA’s decision to keep the branch open followed council’s submission to the federal Senate inquiry, in which she wrote the announcement of the Kingston branch closure “sent shockwaves through our community”.

“Decisions based purely on bottom line results, without significant investigation into individual branch performances, over socially ‘doing the right thing’ flies in the face of being a good corporate citizen,” she submitted to the inquiry on March 30.

“And given that taxpayers, our community, bankroll bank’s significant profits, surely the banks in turn have a moral duty to maintain essential banking services in our regional communities?”

Traeger highlighted that 40.8 per cent of the Kingston council area population is aged 60 years and over, with access to cash becoming an issue for community events such as raffles, local football matches and roadside stalls.

She said some residents do not own a computer nor subscribe to an internet service or have an email address.

“For our community, it is not as simple as moving banking transactions online,” she said.

“Poor telecommunication coverage and extended blackouts are a constant issue and threat, together with system capacity and reliability constraints, already make it difficult for those transacting online.”

She also raised concerns about tourism, hospitality, agriculture and viticulture businesses in Kingston that need “the ability to deposit and withdraw large sums of money”.

“The effect of bank closures on businesses in our townships means that these businesses are unnecessarily exposed to overnight cash and security risks, as they are unable to deposit their takings into a secure night depository facility nor into deposit taking ATMs as these too are withdrawn,” Traeger said.

“In many cases, the business owners will have to travel long distances and several hours with large sums of money, exposed to unnecessary travel and security risk, to deposit their takings at a major service hub that has a banking service.

“This is untenable for business owners.”

Mannum, Tailem Bend branches to stay closed

In a similar submission, Mid Murray Council said the closure of a BankSA branch in Mannum last December was “forcing vulnerable and marginalised (people) to bank using methods that they do not want to or do not have access to”.

Acting council CEO Clive Hempel said Mannum residents now need to make a 60km round trip for banking services that require face-to-face interaction.

“The reality is that our Council district has an aging population who are unable to use or will never own a smart phone or connect to the internet,” Hempel submitted.

“This same cohort is also fearful of scammers and fraudulent activity if they use telephone or internet services for banking, it is a generation that wants to use face to face banking.

“This is compounded by many people living in areas where internet and mobile phone coverage is marginal.”

Hempel said the branch closure also “limits financial choices” for local businesses and their access to financial advice and lending.

“For a small business this can mean closing for a day (loss of income) to travel and access these services,” he said.

“For community groups this can mean spending funds to travel to get a cash float or change bank signatories.”

He called on the federal government to “step in and provide a suitable alternative mechanism” and invest in “in digital connectivity and digital literacy for rural and remote communities”.

Regional bank declines from 2017 to 2022. Table: APRA

Coorong District Council also expressed frustration to the inquiry after BankSA closed its branch in Tailem Bend earlier this year.

The branch was the last remaining face-to-face branch in the Coorong District Council area, according to council CEO Bridget Mather.

“The closure of banks in the District over the past 10 -15 years continues to erode the confidence of expansion and investment by business and the attraction or retention of various cohorts, particularly retirees into the area,” Mather submitted.

“Front of house banking remains a key part of living in regional Australia and the closure of the branch will place considerable strain on many of our residents and businesses.

“Placing additional strain on Australia Post outlets does not ensure that the local community and our elderly and vulnerable members have the services they need.”

InDaily asked BankSA whether the decision to reverse its closure of the Kingston SE branch would be extended to Tailem Bend and Mannum.

A Westpac spokesperson responded that the decision only affects eight regional branches – Tully, Ingham, Cloncurry and Gatton in Queensland; Sale and Robinvale in Victoria; Denmark in Western Australia; and Kingston SE – which were previously announced as closures.

“After further discussions with customers and employees, we’ve decided to keep eight regional branches which were previously announced as closures open,” the Westpac spokesperson said.

“We look forward to continuing to serve these regions.”

‘Considerably disadvantaged’: Govt’s concern for older South Australians

In a submission to the inquiry published in April, the state government said postal banking “cannot be considered a perfect substitute” for local bank branches and warned of a “digital divide” in South Australia.

The government highlighted census data showing South Australia’s regional population had a median age of 47, compared to the Greater Adelaide median of 39.

It said the level of “digital inclusion” in South Australia is below the national average, according to the Australian Digital Inclusion Index.

“Residents and businesses in regional areas without any bank branches or ATMs are considerably disadvantaged, and the impact is felt particularly by older Australians and those with lower levels of digital literacy,” the submission states.

The government added that regional South Australia “is working hard to attract and retain workforce, businesses and service providers in towns [and] the decline in access to banking services is just another challenge in trying to support liveable and sustainable communities”.

“While alternatives such as Bank@Post can provide some of the services offered by bank branches and ATMs, they cannot be considered a perfect substitute or replacement for ADI (authorised deposit-taking institutions) bank branches and ATMs,” the government said.

The government concluded that the impact of regional branch closures “could be alleviated” if the banks work with Australia Post to expand the number of available postal banking services.

Westpac earlier this year postponed the closure of eight regional banks across Australia. The bank’s chief customer engagement officer, Ross Miller, told the senate inquiry in March that Westpac recognised that not all its customers are ready to move online.

“For a small minority, going into a bank branch is still preferred and necessary,” he said at the time.

“This means while there are fewer people using our branches, the absence of one is to have a significant impact on some.”

Miller said decisions to close regional banks were not made lightly, with customer use and proximity to other branches taken into account. He said 96 per cent of transactions were now digital.