Suburban high streets drive ahead as CBD struggles

Adelaide’s suburban shopping strips continue a strong recovery from the pandemic downturn with demand growing for shopfronts on The Parade and Prospect Road while the CBD lags behind, according to a new study.

Norwood's The Parade has the strongest retail occupancy rate of Adelaide's high streets. Photo supplied

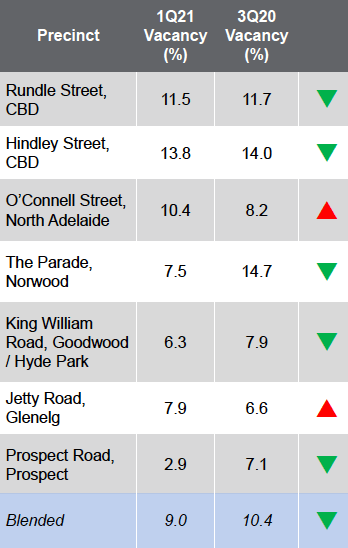

JLL’s latest Adelaide Retail High Street Overview measures the percentage of empty shopfronts along seven of Adelaide’s most prominent retail strips.

The real estate company’s first quarter report for 2021 shows shop vacancies in Adelaide suburbs have dropped two percentage points to 7.3 per cent over the last six months.

JLL says it’s the lowest suburban vacancy rate it has recorded in Adelaide since early 2016.

But suburban demand stands in stark contrast with CBD strips which are more than five points behind at 12.9 per cent – improving just 0.2 points from last year’s survey.

In the same period, the overall vacancy rate across the Adelaide high streets declined from 10.4 per cent to 9 per cent, which JLL said was the largest period-on-period improvement recorded in the study’s five-year history.

Prospect Road leads the way with a vacancy rate of just 2.9 per cent, down from 7.1 per cent last year, although JLL noted it was the smallest retail strip analysed in the report.

Prospect Road’s vacancy rate is 3.4 points lower than the next closest competitor, King William Road in Goodwood and Hyde Park, at 6.3 per cent.

The Parade in Norwood recorded the strongest occupancy surge of all the high streets, with empty shopfronts almost halving from 14.7 per cent to 7.5 per cent.

JLL’s report attributes the gains to a “high volume of new leasing deals” and “retailers absorbing unleased speciality retail space introduced to market in 2019 and 2020”.

JLL’s snapshot of retail vacancy rates across Adelaide for the first quarter of 2021.

JLL research director Rick Warner said The Parade “never really lost its mojo” even when vacancies soared in 2019.

“A lot of that vacancy was supply-driven through new apartment development or conversion to retail from other uses,” he said.

“It’s foreseeable that vacancy along The Parade will keep trending downwards in the future as large-scale mixed-use projects like Como on the former Norwood Mall site and Norwood Green on the former Caroma site on Magill Road complete.”

Warner also said ongoing residential apartment and townhouse developments around Norwood would expand retail trade along The Parade, particularly in the food and beverage sector.

The strong recoveries in the eastern and northern suburbs contrast with CBD hospitality and entertainment strips Hindley and Rundle Street – both of which only recorded 0.2 per cent increases in occupancy.

Hindley Street has the highest vacancy rate of all seven retail strips at 13.8 per cent, but the report states this is “expected” given its “exposure to hospitality retailing” and relationship with the CBD workforce which has spent more time working remotely.

Hindley Street continues to struggle with vacant shopfronts during the pandemic, only recording a 0.2 per cent increase in occupancy over the last six months (Photo: Tony Tropeano)

Occupancy levels along the city’s landmark night-time hospitality strip were increasing before the pandemic hit, with the street recording a vacancy rate as low as 8.6 per cent in the middle of 2019.

But the proliferation of remote work and the disappearance of international students has put continued pressure on the CBD high streets, with Rundle Street also recording the second-worst vacancy rate at 11.5 per cent.

Warner said while the “rapid” return of office workers to the CBD is a positive, a “large proportion” of daily retail expenditure is still missing.

“The removal of the majority of international students from the CBD retail fabric can’t be understated,” Warner said.

“Typically, international students are young, city-dwellers that frequently patron a lot of retailers in the CBD, not to mention provide staff at a lot of retail outlets too.”

Warner said the fortunes of the western side of Hindley Street and Rundle Street would be “intrinsically linked” with the growth of the BioMed City precinct on North Terrace and Lot Fourteen at the former Royal Adelaide Hospital site.

“These two employment zones will inject a significant amount of daily retail expenditure into the CBD high streets and support future retail occupier demand,” he said.

He added that a global trend in remote work is for employees to stay at home on Fridays, which is “really compounding the pain” for CBD retailers.

The JLL report found two bars and one nightclub have been added to Hindley Street since the third quarter of 2020, while Rundle Street has welcomed two new restaurants and a newly leased café on the corner of Frome Street.

The report strikes a more positive outlook for Rundle Street given its proximity to the recently finished Crowne Plaza Hotel and three new apartment developments in the East End.

North Adelaide’s O’Connell Street and Glenelg’s Jetty Road both recorded minor upticks in vacancies, increasing by 1.3 and 2.2 percentage points respectively.

Jetty Road, which had the highest occupancy rate in the last survey, has lost three fashion retailers over the last six months, while O’Connell Street has seen a Flight Centre, an Indian restaurant and a café shut up shop to lift the street’s vacancy rate above 10 per cent.

O’Connell Street remains the high street with the largest proportion (43 per cent) of restaurants and cafes.