Labor promises to axe privatised cashless welfare card

The federal opposition says it will end a controversial, privatised cashless debit welfare card if elected – but backs a government-run alternative being available if communities ask for it.

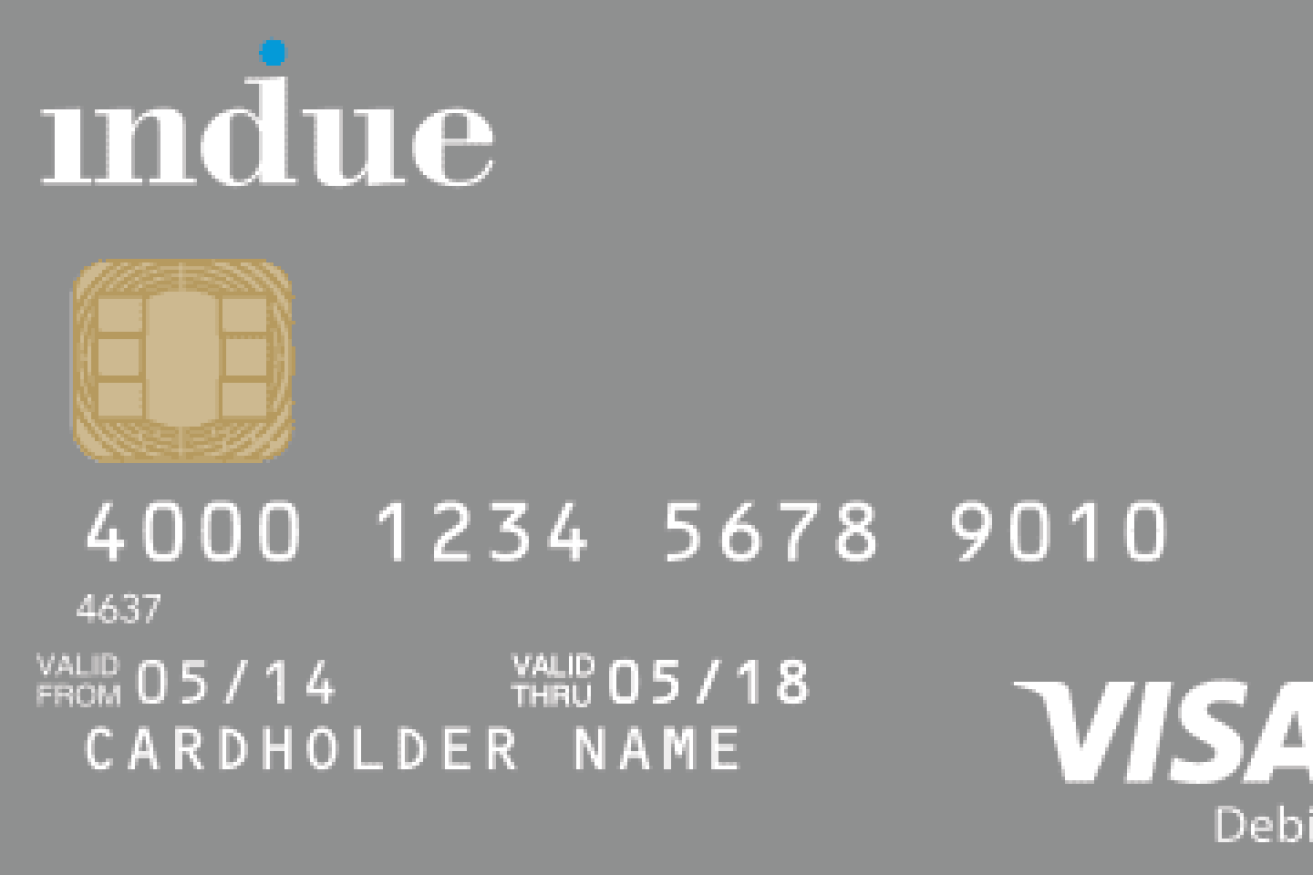

Photo supplied

Labor this week said it would scrap the government’s Cashless Debit Card program and “consult with communities on a localised approach to addressing employment issues”.

The Cashless Debit Card is managed by private company Indue.

The federal government previously paid Indue up to $10,000 per card for the program, while the Australian Council of Social Services last year said initial card trials cost taxpayers $18.9 million, of which $10 million went to the card operator.

The government has since refused to reveal Indue’s payments for running the scheme.

Under the welfare management scheme, 80 per cent of a low-income recipient’s payments are quarantined so that money cannot be spent on alcohol, drugs or for gambling.

The scheme is currently being trialled in South Australia, Western Australia and the Northern Territory. A bid to make the program permanent last year failed but the trial was extended for two years.

Under Labor’s proposal, communities would be able to volunteer to participate in a government-run equivalent of the debit card scheme.

“We think there’s a role if communities are requesting a government-run system in terms of cashless welfare,” Opposition leader Anthony Albanese said this week.

“I don’t want to say that it never has a role … but the idea of a privatised organisation running the welfare system like this and doing it in a way in which they have an interest in its expansion, that’s the thing.

“They introduced the profit motive above what is the public interest. It’s the public interest that’s got to count here.

“The truth is that for some communities, unlimited cashless card assists some communities, particularly women, in remote communities who requested it, effectively, and wanted this to happen for their communities so that they were making sure that they were buying essentials for themselves and their kids.”

Albanese said the federal government’s proposal to expand the card “defies its own evidence”.

The Morrison government has said the card was intended to assist with financial management, encourage people to find work and reduce substance abuse – but findings from studies into the card have found little evidence to support this.

Research from the University of South Australia and Monash University released last year showed “no substantiative impact on measures of gambling, drug and alcohol abuse, crime or emergency department presentations”.

Dr Luke Greenacre, who co-led the study, told InDaily while there had been some evidence of “little pockets of success in specific communities” the card’s average effectiveness was “basically zero”.

“For the cost of the program relative to the benefits that can kind of be supported around the edges, it’s largely not worth pursuing further,” he said.

Greenacre said under the opposition’s proposal, the federal government may need to set up credit card facilities and operate as the supplier.

“One of the ideas behind the Indue card was that it would use the standard Eftpos and credit card systems that are implemented in every store across the country,” he said.

“As it’s currently technologically designed they will need a company to do that for them.

“If they were going to repeal that private company then you’ll need something more akin to a basis card, which again has a very different format of implementation, because that often restricts where you can shop not just what you can buy.

“And a person can’t travel as well with the basics card.”

The Australian Unemployed Workers Union has urged the opposition to “take a principled position for once” saying government funding would be better spent on community programs.

“There are better ways to support people who want assistance with financial management and these programs already exist,” a spokesperson said.

“Instead of wasting public money on income management for people on payments, the ALP should commit to investing these funds in community-designed programs that address the underlying causes of challenges the government claims the Cashless Debit Card and Basics Card are supposed to solve.”