The SA supermarket trumping Coles and Woolworths

Woolworths and Coles may dominate the supermarket landscape, but when it comes to customer loyalty the big two lag behind a much smaller operation, new data reveals.

Outside the Foodland store at Frewville.

Among the big five supermarkets, Foodland – which is based largely in South Australia – was the top performer for customer satisfaction, according to research from Roy Morgan.

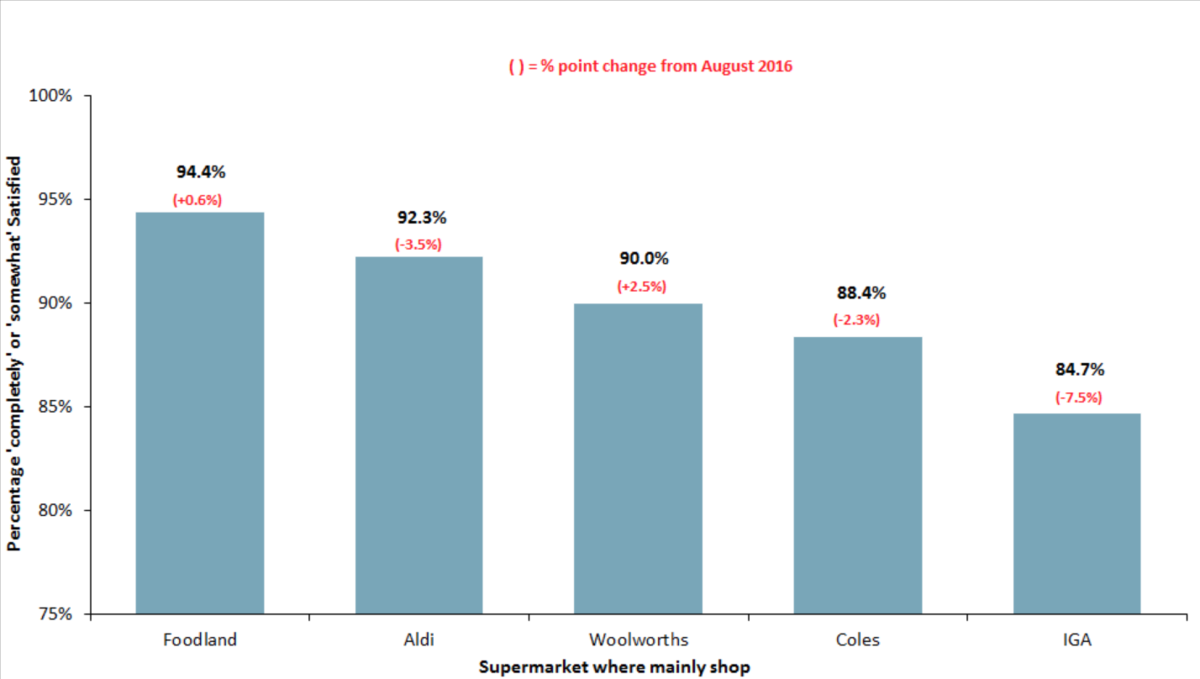

The year-long study involving 12,000 grocery shoppers found Foodland earned a score of 94.4 per cent, above German discount chain Aldi (92.3 per cent), Australian giants Woolworths (90 per cent) and Coles (88.4 per cent), and IGA (84.7 per cent).

According to Roy Morgan CEO Michele Levine, increasingly tough competition among supermarkets and increasing customer demand gives small retailers like Foodland the upper hand in overall satisfaction.

“It’s interesting because Foodland is very small, much smaller than these other players. They seem to be having basically whatever their customers want,” Levine told The New Daily.

“We often find that smaller companies – people who have fewer customers to satisfy – will often manage to satisfy them better.

“People choose where they are going to shop, and the very fact that they’ve chosen a smaller player kind of says what they want.”

Foodland and Aldi outperform Woolworths and Coles in customer satisfaction. Source: Roy Morgan

She said supermarket giants were at the mercy of their overwhelming customer base and in turn unable to compete with local grocers.

“They’ve just got so many customers, and what they’ve got to do is please almost everybody. The vast majority of people shop at either Coles or Woolworths or both,” she said.

“These supermarkets have to satisfy people across the board. At the end of the day it is really hard to satisfy everybody.”

Compared to 2016 figures, Woolworths was the best improver in customer loyalty – up 2.5 per cent – while Foodland increased its customer satisfaction by 0.6 per cent.

Coles (2.3 per cent), Aldi (3.5 per cent) and IGA (7.5 per cent) all saw a decrease in satisfaction levels.

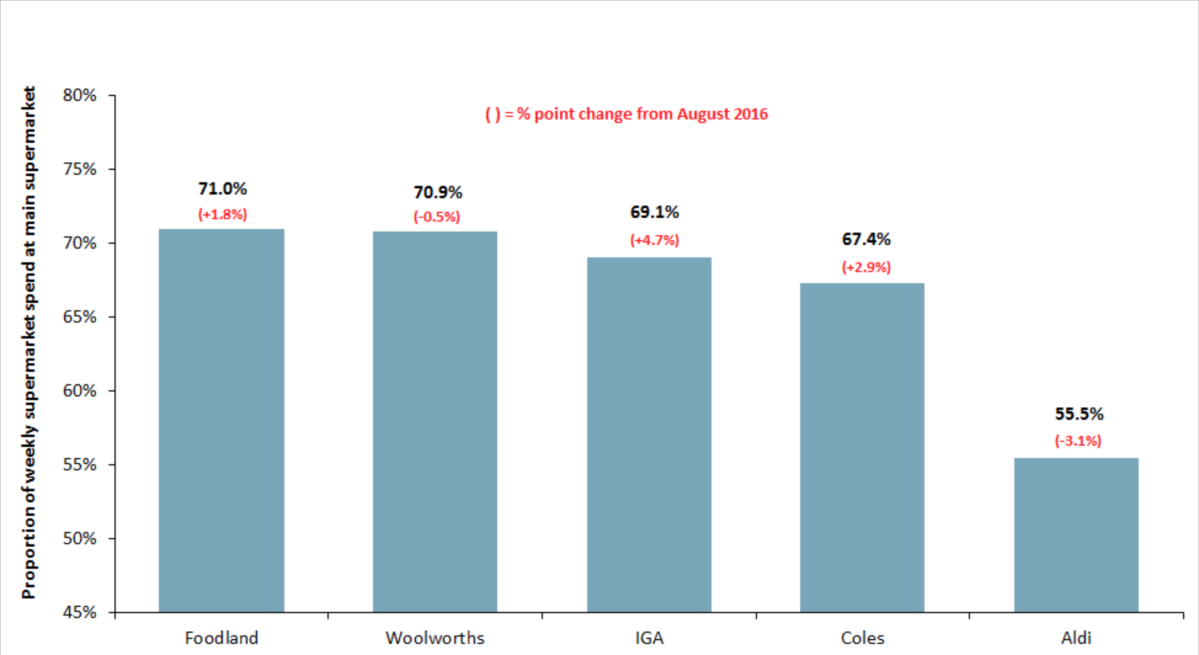

Foodland also led all comers in customer retention, with its main shoppers using 71 per cent of their total grocery spending at the supermarket.

Woolworths, which previously led the majority share in customer spending, fell to 70.9 per cent, compared to rival Coles’ main shoppers who spend 67.49 per cent at that chain, and IGA (69.1 per cent).

Aldi was well behind the other four supermarkets with only 55.5 per cent share of their customers’ spend.

Over the past 12 months, IGA showed the biggest improvement in the share of its customers’ spend (up 4.7 per cent), followed by Coles (up 2.9 per cent) and Foodland (up 1.8 per cent).

Customer supermarket spending trends in the last 12 months. Source: Roy Morgan

Roy Morgan Research industry communications director Norman Morris said supermarkets’ share in customer spending can increase if customer satisfaction is improved.

“Increasing the share of customer spend for the major supermarkets has remained a considerable challenge for some time,” Morris said.

“This is evident by the fact that over the last five years, all of the top five supermarkets have seen a decline in the share of their customers spend, despite various attempts at loyalty programs.

“There appears to be plenty of scope to increase supermarket sales if customer loyalty can be improved.”

According to the data, Foodland was the overall satisfaction leader and scored the highest satisfaction rating of the big five for its dairy, delicatessen, fresh fruits and vegetables, and fresh seafood departments.

Meanwhile, Aldi led satisfaction in packaged groceries category, and Coles and Woolworths shared the title for bread.

IGA had the lowest overall satisfaction and was not the best performer in any major product area or section.

Foodland and IGA are both owned by Metcash.

This article was first published at The New Daily.

Clarification: While the Foodland brand is part of the Metcash stable, the Foodland supermarkets in South Australia are independently owned and operated, commonly by local family businesses.