As the calendar hits June, it’s time to cast your mind to your superannuation situation to make the most of its possibilities for the end of financial year.

Firstly, check your current balance and level of contributions through the year.

This can be easily done by logging in online with most funds or using your MyGov account.

If you have salary sacrifice arrangements in place, you can also check with your boss to determine whether these contributions have actually been made.

That is the best way to ensure that you aren’t a victim of unpaid super and if there appears to be discrepancies, take it up with your fund and your boss to see what is going on.

Superannuation contributions

The superannuation guarantee rate currently stands at 11 per cent of salary but if you have extra cash you are able to contribute more.

Simone Murray, a planner with Rasiah Private, says this year it may pay to think ahead and see if you can afford to contribute a little more.

“On July 1 tax rates will come down, so if you can top up your super now you get the tax benefits of slightly higher rates this year.”

Source: ATO

Also you will have a few extra dollars in your pocket after the tax cuts so you can perhaps afford to pay in a little more now.

Contribution types

There are a few contribution types you can use to boost your super if you have the capacity to do so.

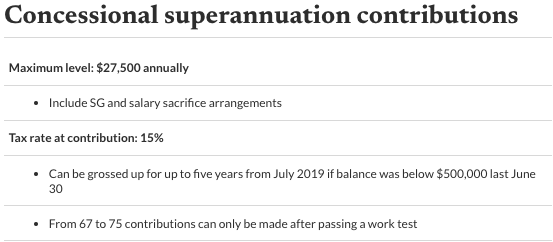

Concessional contributions

These are contributions that are taxed at a concessional rate of 15 per cent, which is lower than the marginal tax rates of 30 per cent or more that many people pay.

Source: ATO

The maximum concessional contribution level is $27,500 so if you have not reached this level through your SG and other contributions you have the option of tipping in a bit more.

Doing so will deliver a tax benefit of the difference between 15 per cent and your marginal tax rate so you can boost your retirement balance and withhold something from the tax man.

If you want to make extra contributions of any type, get onto it now.

“Theoretically you can make contributions up to June 30 but most funds have a cut-off date of around June 25,” Murray said.

Contribution forms can be found on your fund website and generally payments can be made by direct debit.

Catch-up contributions

If you’ve got extra cash and have a super balance of less than $500,000 last June 30 you can use any unused concessional caps with a catch-up mechanism.

That means you can go back five years to July 2019.

For the first three of those years the concessional cap was $25,000 and for the past two it has been $27,500.

So that gives plenty of room for anyone with extra cash to make a contribution.

To work out how much room you have you will need to tally up previous contributions and subtract those from the maximum allowable limits.

Remember to fill out a form available from your fund that signals your intent to claim a tax deduction available from your fund.

Although the contribution needs to be made before June 30, you have the next financial year to complete the form.

But it’s best to do it quickly to get the tax benefit sooner.

Also if you are aged between 67 and 75 you can only make concessional contributions if you pass a work test.

That means you need to show you were in some sort of paid employment for a period of 40 hours in 30 days.

Non-concessional contributions

These are monies you put into your fund without claiming a tax advantage and can be used for significant amounts of money.

Currently limits are $110,000 annually with a three-year carry forward of $330,000 available. See the attached table for details of balance limits applying here.

They can be useful for those selling an asset or receiving a windfall to boost super in the run-up to retirement.

Source: ATO

“Think about your age and future needs before making these because you can’t access your super till reaching the preservation age of 60 and you might need the capital in the meantime,” Murray says.

Remember you don’t need to be intimidated by some of the big numbers quoted here.

Any extra contributions you can afford will pay dividends over time.

Spouse contributions

Where one member of a couple earns $40,000 or less, a super contribution can be made by the higher income partner.

A contribution of $3000 can be made as a non-concessional contribution to the low-income spouse’s fund.

The government then delivers a tax offset of $540 to the contributing spouse, which reduces after an income of $37,000 is reached and disappears when the partner’s income reaches $40,000.

Super contributions splitting

After the tax year you can choose to split your super contributions with your spouse.

To do so boosts your spouse’s balance ,which could be useful in building their retirement.

Your fund will have the necessary documents but you need to check with them what sorts of contributions can actually be split.

Splitting is restricted to payments totalling $110,000 and cannot be made if your spouse has a balance of $1.9 million or more.

Source: HESTA

This benefit is designed to help low- and middle-income earners boost super.

If you have an income of $58,445 or less and you make a personal, non-concessional contribution of $1000 to your super, the government will give you a maximum co-contribution of $500.

The maximum amount goes to anyone earning up to $43,445.

It’s attractive because you get $500 into your account, tax free, which is effectively a 50 per cent rate of return.

Remember you have to make the contribution as non-concessional or you won’t get the benefit.

Also lodge a tax return to be sure you get the payment.

Low-income super tax offset

If you earn less than $37,000 and at least 10 per cent of that comes from work or business, then the government will square up your effective super contributions tax to ensure that you are not paying more to your super contributions than your wages.

You don’t need to do anything other than lodge a tax return here and the ATO will recompense you for up to $500 in excess tax paid through super contributions.

This article first appeared in our sister publication The New Daily, owned by Industry Super Holdings.