SA Business Index: Big deals define top-end reshuffle

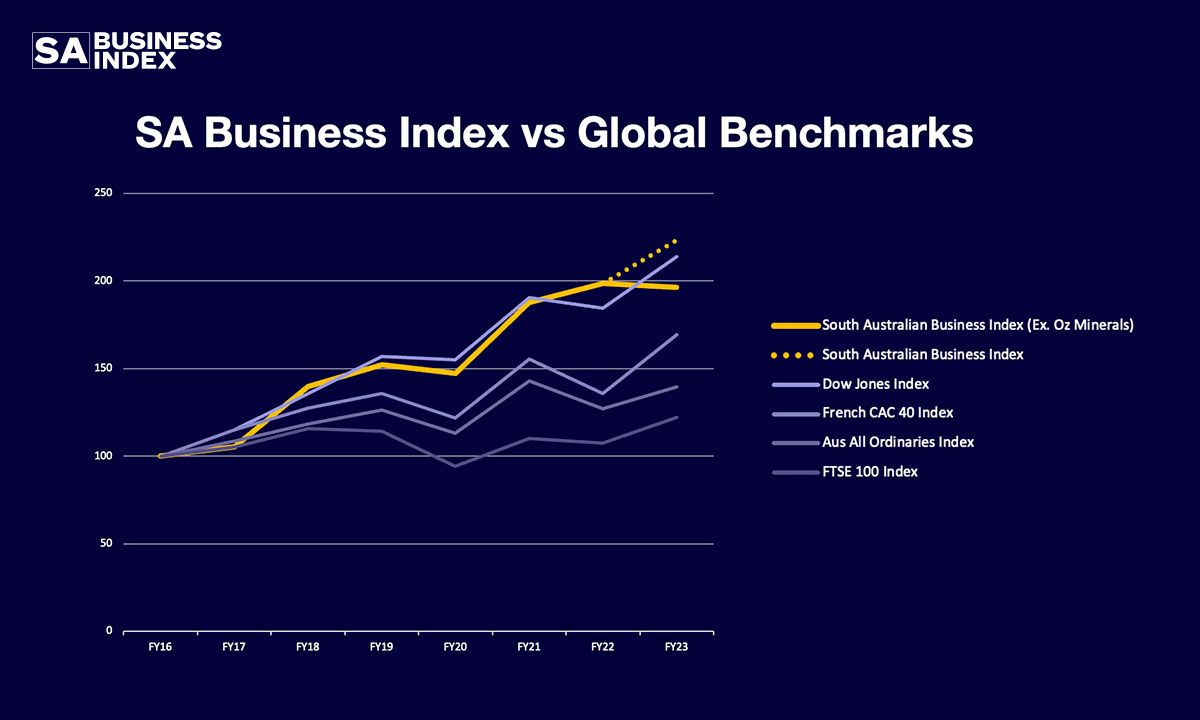

A troubled construction sector, inflationary pressures and the cost-of-living crisis defined the last financial year, but Adelaide’s top end of town pulled up well with major transactions making waves in the top 10 ranked businesses in South Australia.

Photo: Tony Lewis/InDaily.

The perennial leader of the list, oil and gas giant Santos, remains in top spot on the South Australian Business Index after reporting 65 per cent revenue growth to $10.5 billion – the second highest growth rate of all companies on the Index.

The Flinders Street-headquartered giant, which also took out the Standout Large Employer award today, dominates the Index of South Australia’s top 100 companies. With a valuation of $25.7 billion, the company constituted 35.9 per cent of the total Index by value.

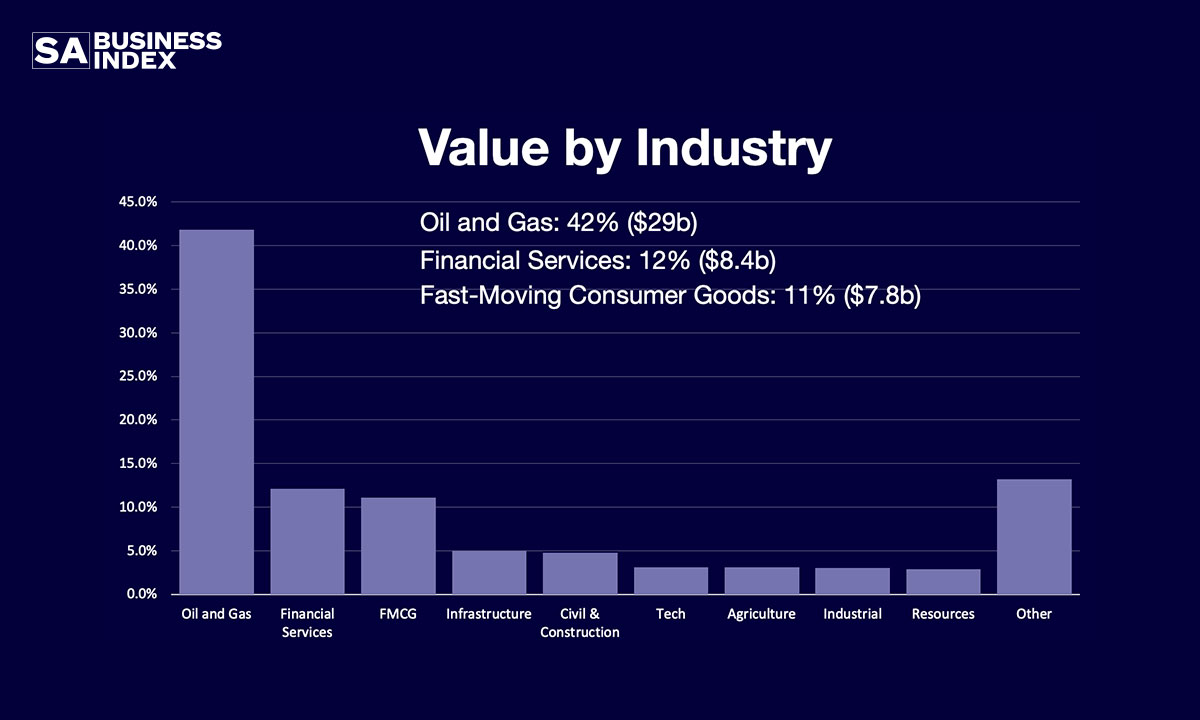

Its size also contributed to oil and gas’ top position by industry value, with the sector making up 41.8 per cent of the Index. The second largest industry by value was financial services – the top company on the list from this sector being Argo Investments in the number two spot.

The South Australian Business Index is the definitive ranking of the top 100 companies in the state over the 2022-23 financial year.

Analysis by Adelaide financial services firm Taylor Collison for InDaily’s South Australian Business Index showed that resources were the top represented sector on the list in terms of number of companies by industry at 15. For comparison, just six companies in SA work in oil and gas.

This year’s list, revealed today at the Adelaide Convention Centre, saw companies fill in the void left by OZ Minerals – last year’s number two on the Index. Following the acquisition of the Adelaide headquartered copper miner by BHP, its replacement on the Index was a key question this year (BHP is not headquartered here so isn’t eligible for our list).

READ MORE: SA’s Top 100 Companies

Argo Investments ultimately claimed that spot. The listed investment firm was ranked third in 2022 and was an obvious contender for runner up, having maintained its valuation through rocky market conditions, inflationary pressures and a cost-of-living crisis.

The company, which has a valuation of $6.9 billion, was a beneficiary of a “flight to safety” in the stock market, whereby both retail and institutional investors locked money into safer pastures rather than taking punts on small caps and newly listed and unproven scale-ups.

That trend could benefit listed firms in SA’s top 10 for another full financial year: with no interest rate relief expected Australians will likely put their money on safer horses.

If confidence returns to the market, bottom-ranked companies might get a bit of a boost next year after losing steam in 2022-23. Listed geospatial tech company Aerometrex fell five places to the 99th spot, while oil and gas company Vintage Energy fell 18 spots to 97.

The latter experienced a fall in line with a broader trend for oil and gas companies. While the sector dominated by value, firms within the sector took a major tumble this year diving by a cumulative 80 spots.

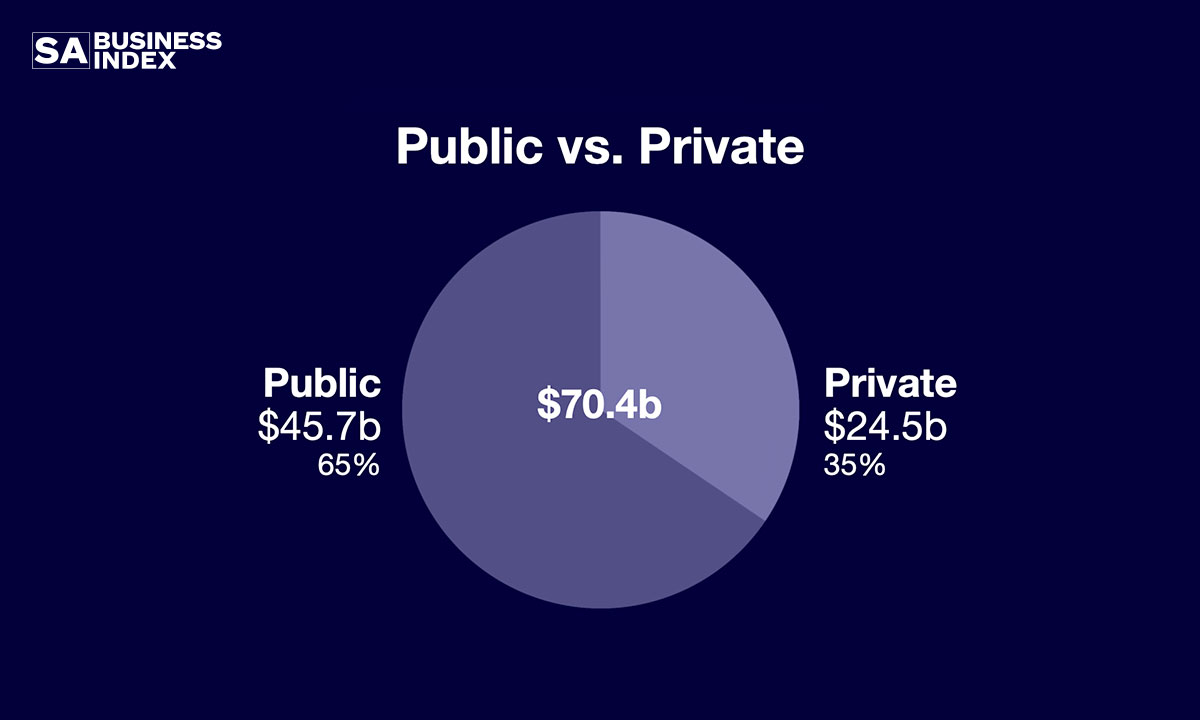

OZ Minerals’ departure also meant the total valuation of the 100 companies took a $9 billion hit. Further, the miner’s absence skewed the percentage of private businesses to 35 per cent, up from 26 per cent last year.

However, in a sign of resilience for the state economy, the total Index size was on par with last year despite OZ Minerals becoming Victorian-owned.

The biggest falls overall were recorded by NeuRizer (down 38 spots) and Maggie Beer (down 34).

As for the largest riser, that honour went to Hillgrove Resources which climbed 40 rungs on the Index.

In terms of revenue growth, Chrysos Corporation (ranked 17) experienced the biggest boost, with revenue rising by 111 per cent. The mining-tech company also more than doubled its valuation and rose by 15 spots on 2022.

Special note should be paid to new entrants on the Index, particularly Flavia Tata Nardini-founded space firm Fleet Space Technologies which won the Best New Entrant Award after debuting in the Index’s top 30.

Other new additions include LMS Energy, Samuel Smith & Son, Leed Engineering and Construction, Celsus Holding, Archer Materials, Adrad Holdings, Fairmont Homes, Investigator Resources, Exact Contracting, FCT Holdings, Adsteel Brokers, Mayfield Group Holdings, Mykra, Marmota and IJF Australia.

Another major transaction in the past financial year was the purchase of Peregrine’s chain of convenience retail outlets OTR by Viva Energy for $1.15 billion.

Earlier this week, InDaily mulled whether this would see the Shahin-family owned business rise or fall on the rankings. It turned out to be a boon for Peregrine which leapfrogged Beach Energy to become South Australia’s third largest company in 2023.

At the number five spot was another company owned by one of SA’s richest men – Thomas Foods – which rose from ninth last year. Transport operator Kelsian Group also jumped up eight spots to sixth, while Flinders Ports climbed by one rank to seventh position.

The top 10 was rounded out by Adelaide Airport (eight), Discovery Parks (ninth) and ADBRI (tenth).

The latter defied a construction industry downturn to move up three spots as companies in the building supplies industry took advantage of a solid pipeline of projects. While businesses engaged in constructing Adelaide’s buildings might be on the ropes, those supplying materials for the backlog of major infrastructure and construction projects are proving resilient.

On the other end, companies in agriculture saw revenues fall noticeably, with the only business in the sector seeing increased revenues being Elders (up 41 per cent).

Methodology

To be eligible for the Index, businesses must be a South Australian entity incorporated in SA, have a head office in SA, or be an SA-operated entity, majority owned by South Australians.

Each company is ranked by Taylor Collison by market capitalisation using the following formula:

- ASX – market cap (share price plus the number of ordinary shares on issue).

- Private entities – estimate market cap considering company revenue, industry standard profit margins and applying earnings multiple.