Ask the Expert: Know the options – and find the best super plan for your needs

Financial adviser Craig Sankey answers your superannuation and other finance questions each week, and today looks at the ins and outs of superannuation and the best super plan for different scenarios.

Question 1

My wife and I are for all intents and purposes retired – aged 64 and 60. We are doing fine on passive income (one freehold investment property and about $600k in cash deposits) outside of super, which is still in accumulation phase. About $300k and $200k of super are there any advantages or disadvantages in leaving our super in accumulation phase?

Retaining funds in accumulation (not starting a pension with the funds) has the following advantages:

- Your funds will hopefully continue to grow, assuming positive investment returns, as you are not required to make minimum drawdowns

- You can maintain any insurance benefits attached to your super

- While this is perhaps not as applicable to you, another advantage is that funds in accumulation are not counted by Centrelink under their income or assets tests until you attain age pension age.

The main disadvantage is that all internal investment earnings within your super are taxed at 15 per cent.

While this may be lower than your marginal income tax rate, you could reduce it to zero tax by converting your super to an income stream, such as an account-based pension or lifetime annuity.

As an example, based on $500,000 in super, if it achieved an 8 per cent return this would equate to $40,000.

However, the super fund has to pay earnings tax at a (maximum) rate of 15 per cent. This means $6000 of the $40,000 may be lost to tax. In pension phase this tax is not applicable, so the fund (and therefore your account) would keep the whole $40,000 in earnings.

As mentioned above, once you move funds to an income stream you have to start drawing down a percentage of your balance each year. You don’t need to spend it, but you do need to start receiving an income into a bank account.

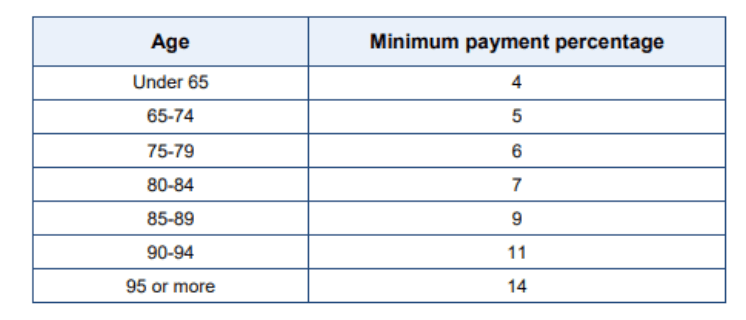

The minimum amount needed to be drawn from your super is a percentage of your account balance, and is based on your age, as shown in the below table.

When you are younger you only need to draw down modest amounts, as you get older the percentage increases.

Question 2

I am nearly 59 and have very little in super. My father has just passed and I would like to sell his townhouse to buy a little unit for myself, to get off the rental roundabout. He also had some $100,000 in savings. Would I be best off putting that money into my super or buying a more expensive home? I work casually and intend to do so for the foreseeable future. I am really frightened of entering my older years with no financial security. I am single.

Sorry to hear about your father.

Financially, you now have an opportunity to get some stability and hopefully ease your anxiety about financial security.

It’s good you are thinking about buying a home and super, the two most common assets Australians own.

A home can provide you with a lot of security. Most older Australians who live below the poverty line are both single and renters.

So yes, buy a home but make sure it’s within your budget and that it won’t require high maintenance costs going forward.

Once you turn 65, or if you change jobs from age 60 (whichever is sooner), then all of your super will become accessible and can be paid to you tax free.

So again, yes, adding extra to your super now is a great idea as it will then be able to grow and be converted to an income stream in retirement. And given your age it’s not going to be locked up for too long.

Just ensure you leave some funds in a bank account to cover expenses until you retire.

Question 3

Craig, I retired last year, converted my accumulation account to a flexi pension. That is going well. I also have a Defined Benefit account, which is a legacy of my employment with various governments. It’s about twice the size of my pension account. My question is: What can I do with it? As far as I can see, my only option is to transfer the whole balance to my pension account. Is that correct? Is there any better use for it?

Many government defined benefit super funds provide the option of converting them to a lifetime pension, usually at favourable rates.

Therefore, I would first check with your fund as to whether this is an option. If so, they can provide further figures around it. Note, you may also have the option of converting only a portion to a lifetime pension if you don’t want to lock it all away.

If no lifetime pension is available, then you could either cash the money out or convert it to another flexi pension.

If you wanted to combine your defined benefit fund with your flexi pension you may need to roll both into an accumulation super account, where from there you can start a new combined flexi pension.

Craig Sankey is a licensed financial adviser and head of Technical Services & Advice Enablement at Industry Fund Services

Disclaimer: The responses provided are general in nature, and while they are prompted by the questions asked, they have been prepared without taking into consideration all your objectives, financial situation or needs.

Before relying on any of the information, please ensure that you consider the appropriateness of the information for your objectives, financial situation or needs. To the extent that it is permitted by law, no responsibility for errors or omissions is accepted by IFS and its representatives.

This column also appears in our sister publication The New Daily, which is owned by Industry Super Holdings.