Winners and Losers: Stelar Metals loses its shine on lithium mine update

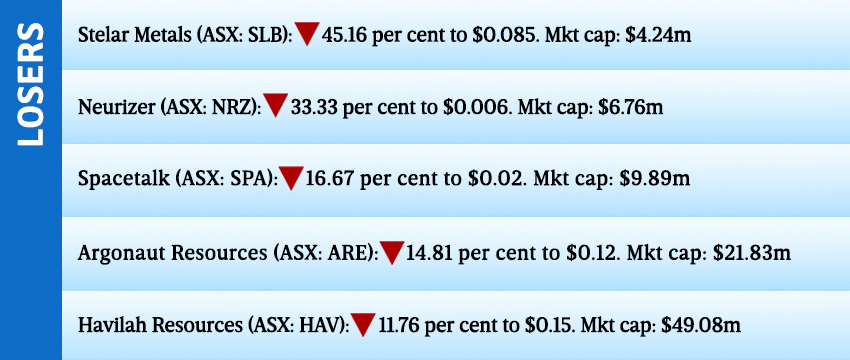

A South Australia-based lithium player slid on an update about its Broken Hill project, as did Santos after announcing its proposed $86 billion merger with Woodside was not moving forward.

The first results from Stelar Metals’ drilling campaign at the Trident Lithium Project in Broken Hill were promising from CEO Colin Skidmore’s perspective, but shareholders were less than impressed.

Shares fell dramatically on February 7 after the announcement and remained depressed at the time of writing with the company’s market cap – $4.24 million – nearly half of what it entered the week at.

“Our initial drilling has confirmed Stelar’s view that the large-scale pegmatite system at Trident has the potential to host high-grade lithium mineralisation,” CEO Skidmore confirmed.

“Drillhole TRD001 confirmed high-grade lithium in this newly identified system that warrants further follow-up – with the lithium-rich pegmatite identified in the initial drilling Trident open to the north.”

Argonaut Resources – soon to be re-named Orpheus Uranium – was another mining company that landed in the Losers list this week despite announcing it had applied to explore a parcel of land near the uranium-rich Honeymoon site in SA’s northeast.

Neurizer was was almost a Winner after announcing it had penned a non-binding term sheet with Samsung C&T Corporation – Samsung’s construction and engineering arm and the business’ founding division – to potentially sell fertiliser to the Korean multinational.

Shareholders initially cheered the news – sending shares up by 14 per cent on the day – but the firm’s fortunes soon took a turn to close 33 per cent lower for the week.

Spacetalk and Havilah Resources rounded out the top five Losers for the week.

Though not in the bottom five, Santos gets a mention this week after sliding down more than 6 per cent in the five days following news that merger talks between it and West Australian-giant Woodside had ended.

Shares in the company sit at $7.32 per share – the lowest level in 2024 so far, but on par with where the company was at in mid-December immediately before news that Santos and Woodside were mulling the merger.

As for the Winners, 1414 Degrees hit the top spot on slightly above-average weekly trading volume.

PNX Metals also surged for a second week straight, including the highest daily trading volume it experienced in over a year, with investors buoyed by high-grade drilling results from its Thunderball and Goldeneye uranium deposits.

“These are fantastic results and add considerable excitement to our planning for the 2024 field season,” PNX executive chairman Graham Ascough said.

“As we go through the large volume of historic data it is apparent that there are a number of high-priority, near-surface targets that require further evaluation. The 2014 drill program was limited in scope but demonstrates the potential for high-grade domains in both the upper and lower lodes at Thunderball and the potential for new near-surface regional discoveries.

“The association of potentially economic grades of platinum, palladium and gold with uranium at the Goldeneye prospect is also compelling due to its similarity with the Coronation Hill deposit to the east.”

Eyre Peninsula battery and critical minerals explorer Itech also rose following positive drilling results from its Lacroma Graphite Prospect.

Maggie Beer Holdings and Marmota Limited rounded out the top five Winners for the week.

The full list of Winners and Losers as of 9 February 2024:

Data compiled by Baker Young Limited analysts.