How changes to superannuation in 2023 helped deliver you a higher balance

Make sure you are in a well-performing super fund now that new rules apply, writes Rod Myer.

Photo: Scott Graham

Despite frequent calls from the superannuation industry and fund members to end the changes that have turned the system on its head in recent years, there were more changes in 2023.

If you are a super fund member these changes are welcome.

The best news of all for members was the fact that the Super Guarantee that bosses pay for employees increased from 10.5 per cent to 11 per cent on July 1.

That means a person on the average annual salary of $1838 per week, or $95,576 annually, will see an extra $477.87 paid into their super fund in the 12 months to July 1, 2024.

For someone on a more modest salary of $60,000 a year the increase will be $300.

Come July 2024, the SG will increase again to 11.5 per cent, with the current target of 12 per cent scheduled to be reached in 2025.

Performance tests

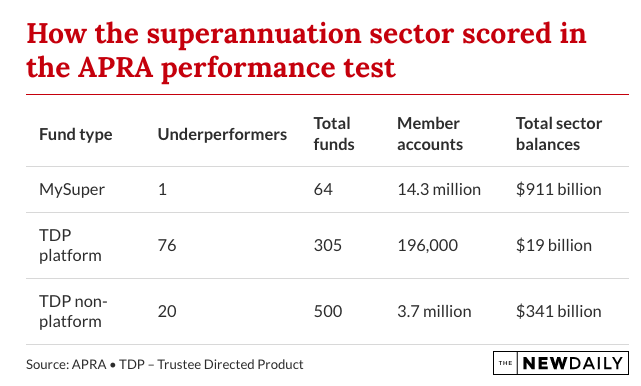

Regulator APRA expanded its performance test regime from default funds to a significant part of the choice sector in 2023 and the results were sobering.

It found that 12 per cent of super products being sold to the public had underperformed. But that underperformance had been almost exclusively among choice products.

Only one default or MySuper product had failed the test.

That was AMG’s MySuper product and its trustees have pledged to close it down following three years of underperformance.

The total number of choice products – those that members choose to invest in rather than just being moved into by their boss – that failed the test was 96 and these covered 60,000 individual accounts.

Overall, choice funds make up $360 billion in balances, compared to $911 billion for the MySuper sector.

The value of performance testing has been demonstrated since the practice was introduced in 2021 for default products.

Back then 13 funds failed, followed by five funds in 2022, and only one default product in 2023.

Funds highlighted as underperformers have acted quickly, said Xavier O’Halloran, director of Super Consumers Australia.

“Our research has shown products which previously failed the performance test cut their fees by 20 per cent on average,” he said.

To check if your fund was an underperformer, look here.

Unpaid super

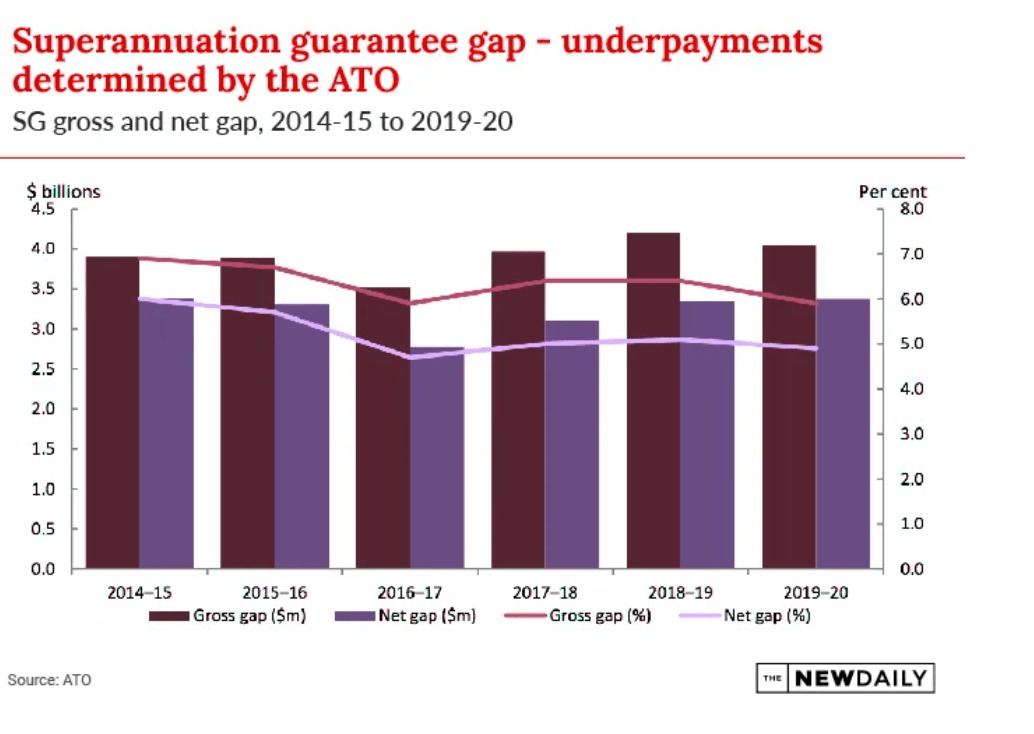

The ATO flexed its muscles in 2023 to collect super owed to workers but not paid over.

The tax man won back $528 million in super from recalcitrant employers and hit them with another $157 million in penalties.

The tax man being on the unpaid super trail spooked bosses to pay another $445 million in underpayments voluntarily rather than face the ignominy of a fine and being called out.

So all up $1.13 billion in unpaid super was delivered to employees.

Although that is welcome the ATO estimates that 2.9 million Australian workers are losing $4.8 billion in unpaid super each year.

Over eight years that could be as much as $38 billion.

So while the ATO lifted its game there is still some $3.6 billion in unpaid super owing to about 2.68 million workers for 2023.

The latest federal budget delivered the ATO another $27 million to chase down unpaid super.

Cost of owning a super fund

Two factors make up super returns – investment returns and the cost of running your fund.

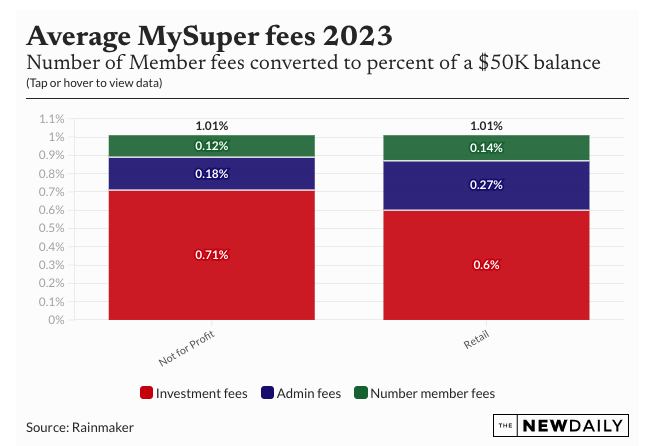

Research from SuperRatings found that overall super fund fees had fallen by 2 per cent over the past year, with Australians now paying $32 billion to have their super managed.

Super fees have fallen by 2 per cent over the past year, with Australians paying the fees on their $3.5 trillion in retirement savings, according to research from Rainmaker Information’s Superannuation Benchmarking Report.

Self-managed superannuation funds remain the cheapest segment, with average fees of 0.65 per cent, largely because they have extremely high balances.

SMSF balances average $710,000, while the average pooled fund, where most Australians invest, has a balance of $170,350 and consequently higher relative costs.

The MySuper or default sector is highly competitive with fees averaging 1 per cent at June 30.

“MySuper fund fees fell from 1.05 per cent to 1.00 per cent over the year to June 2023, a significant reduction,” said Pooja Antil, research manager at Rainmaker Information.

In the MySuper category not for profit and retail funds now have fees at virtually the same level.

Cost of retirement

Inflation made itself felt over 2023.

After peaking at 8.4 per cent in December 2022 it declined to 4.9 per cent in October 2023 and 5.4 per cent for the annual rate in the September quarter.

That inflation is making itself felt in the lifestyles of retirees.

The latest annualised figures from the Association of Superannuation Funds of Australia (ASFA) showed that the annual expenditure needed to reach ASFA’s comfortable retirement standard hit a record high of $71,724 per year for home-owning couples in the September quarter.

For singles that figure hit $50,981.

Overall the cost of a comfortable retirement rose at 5.5 per cent – about the same rate as the September-quarter CPI inflation.

A modest retirement cost $46,620 for a couple and $32,417 for a single in September.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings.