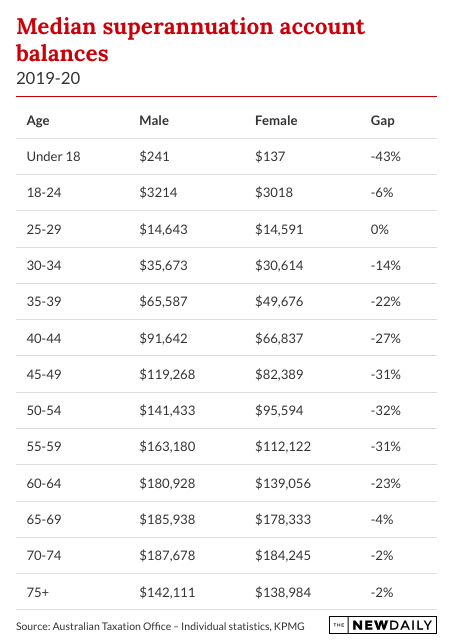

While there has been some improvement in the super gender gap in recent years, women still retire with about 23 per cent less than men.

But the widest gap is in mid-life with the figure in the early 30s between 45 to 59 per cent less than men, according to the report Towards Gender Equity in Retirement.

“The gender gap increases during child-rearing years because many women are out of the workforce or working part-time,” said the report’s author, Linda Elkins, KPMG’s asset and wealth management leader.

Overall, the median super gender gap is about 13.3 per cent.

But it’s not only child rearing that is keeping women out of the workforce.

Women typically take on caring roles within the family that can take massive slabs of what would otherwise be their working lives and the result is significantly lower retirement balances.

On average, Australian men do an estimated 172 minutes of unpaid work per day compared with an estimated average of 311 minutes per day for women.

That means women on average do 80 per cent more unpaid work than men.

Women, therefore, also dominate those receiving the carer payment, making up 70 per cent of recipients.

And those duties significantly erode their potential retirement balances.

“For a person who began caring at 35 years of age and continued to provide care and receive the carer payment for 15 consecutive years thereafter, the addition of SG contributions to the carer payment could be expected to boost the carer’s superannuation balance at retirement age by $123,000,” the report found.

Although 15 years might sound a lot for a period of caring, such responsibilities can include looking after infirm parents or family members as well as children with special needs.

Those can be long-term commitments.

Some 24 per cent of people on the carer benefit receive it for more than 10 years and 25.46 per cent receive the benefit for between five and 10 years.

Even taking time out for caring towards the end of your working life has a big impact on super balances.

KPMG found that someone who started caring for a frail-aged parent at the age of 50 and received SG contributions on the Carer Payment for 15 consecutive years thereafter would retire with an additional $68,000 in superannuation.

Long-term cost

The carer benefit with all associated allowances totals a maximum of $29,624 per annum for a single, compared with $42,255 for a worker on the minimum wage.

Recipients are allowed to work up to 25 hours a week, but 91 per cent of carer payment recipients in December 2022 had received no additional earnings from employment in the prior fortnight, the report found.

That means less than 10 per cent of carer payment recipients are accumulating superannuation while performing unpaid caring work.

Effectively that means society not only gets the benefit of this unpaid caring work but also denies these carers the tax-funded retirement benefits going to middle- and high-income workers in the workforce.

KPMG found paying SG to long-term carers would cost an average of $45,000 over their caring years but would boost super balances by as much as $123,000.

“There would be benefit to the budget because the costs [of the SG payments] would help offset the age pension and other benefits as a result of people having more super to retire on,” Elkins said.

A net saving

The measure would be estimated to cost the budget $1.1 billion by 2027, but if it attracts more people into the home caring space then the overall effect on the budget would be a net saving.

That’s because the cost of home care, even with SG paid, is cheaper than formal care in a health or retirement facility.

Women in Super CEO Jo Kowalczyk said she supported the call to pay the SG on the Commonwealth carer payment.

“It is one of a number of measures required to address gendered superannuation inequalities that leave women worse off in retirement,” Kowalczyk said.

“Women in Super believes that both paid and unpaid caring work should be recognised as an important contribution to our economy,” Kowalczyk said.

Women in Super has also called for SG payments for those on parental leave and an annual $1000 bonus to be paid into super for low-income workers till their balance reaches $100,000.

KPMG also called for a tax offset for carers returning to the workforce.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings