SA business confidence dips: BankSA survey

South Australian business confidence has declined over the first half of this year with the latest BankSA index showing its biggest fall in two years.

The Government is talking up the latest BankSA business survey but it actually shows a dip in confidence. Photo: Tony Lewis/InDaily

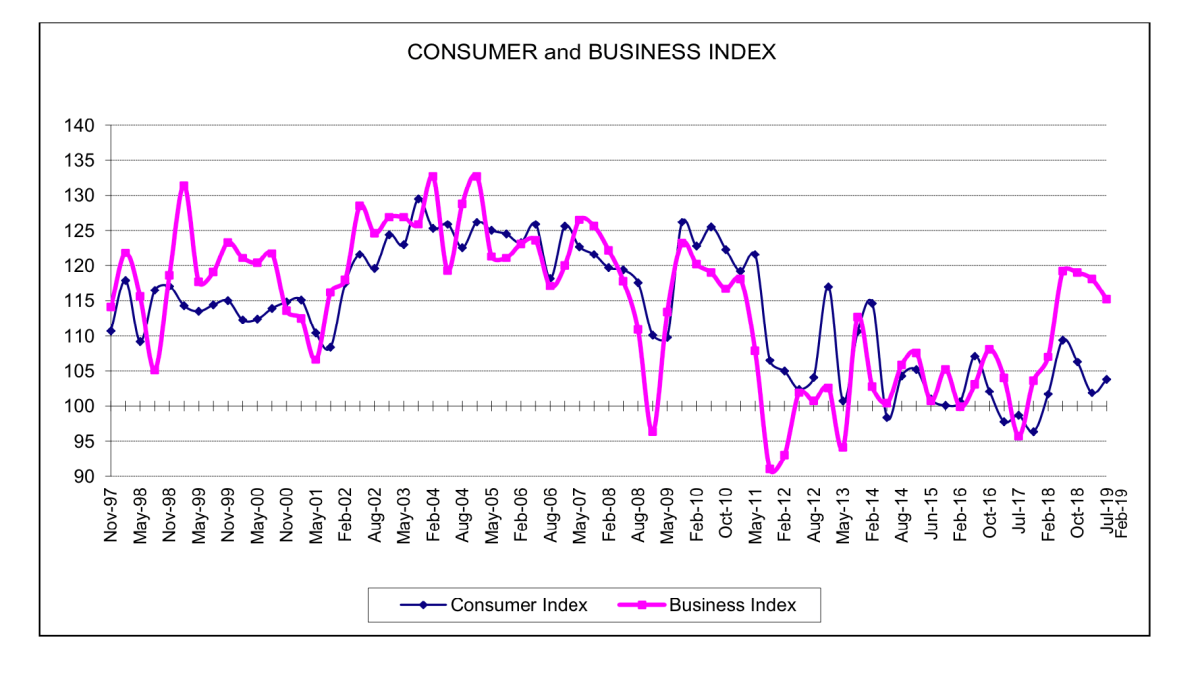

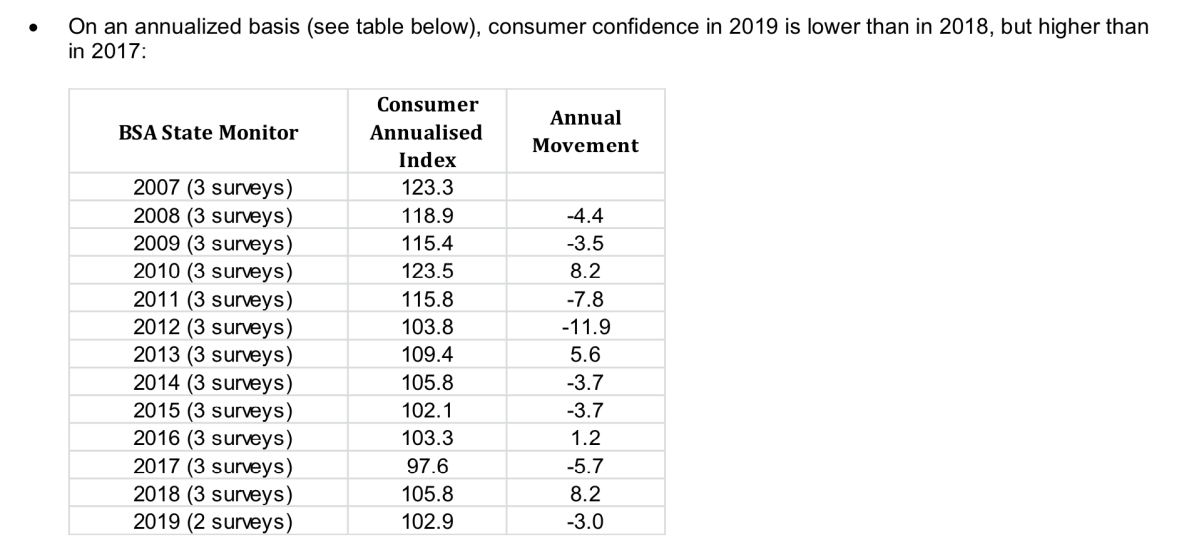

The Bank SA State Monitor, conducted three times a year, shows the business confidence index falling slightly between February and July this year, while remaining at a higher level than any time between mid-2011 and early 2018.

The monitor’s index had been rising steadily since July 2017, recording a significant leap in the first half of 2018 as the Liberals took government in South Australia. The index has been declining in the three surveys since then, while remaining in positive territory.

The latest survey shows the proportion of businesses intending to make major purchases in the near future was at a record level and job creation expectations were also positive, “however, the survey showed more business owners have been affected by a downturn in turnover”.

“This is combined with lower confidence about the climate for doing business in SA over the next 12 months, in addition to perception that small business activity in the state is lower,” the bank said.

Consumer confidence increased slightly in the survey period after two consecutive falls.

100 is the index baseline, above which indicates optimism and below which indicates pessimism. Source: BankSA State Monitor

Bank SA chief executive Nick Reade said that while some businesses were doing it tough, particularly small and “micro” businesses, he was encouraged by the survey results.

“With businesses foreshadowing increased investment and employment in coming months, it is hoped that consumer confidence continues to rise and provide further stimulus for the economy,” he said.

The survey showed a split in sentiment between sectors: community services, financial services and manufacturing industries recorded the biggest increases, while construction, retail and recreational industries recorded the largest decreases.

Treasurer Rob Lucas welcomed the findings of the survey.

“While we recognise there is always more work to be done, these results are encouraging and reflect support within the broader business community for the Government’s positive economic agenda, as we strive to create more jobs, sustained population growth and attract greater investment,” he said.

“The survey also comprehensively puts paid to claims of economic ‘doom and gloom’ by our political opponents, who seem intent on talking South Australia’s economy down.”

SA Best MLC Frank Pangallo expressed scepticism about the positive aspects of the survey, saying the Government’s controversial land tax aggregation proposals were already affecting the local economy.

He has called a community forum for midday Sunday to discuss the land tax reforms.

“Make no mistake, the state’s economy is being impacted now by proposed new land tax reforms that might or might not come into force from July 1 next year,” he said.

“That started the day Treasurer Rob Lucas flagged the changes – and has been in steady decline since.”

Another measure of local business sentiment will be revealed next week, via Business SA’s regular survey of business expectations.

The South Australian economy faces wider headwinds, with locally-headquartered industrial giant Adelaide Brighton reporting softer expectations for profits in the face of the Australian construction downturn – a dynamic that has claimed a growing list of local building companies over the past year.

The BankSA surveys findings on retail confidence are also reflected by the broader economic environment, with the South African owners of the David Jones department stores claiming today that the Australian retail sector is in recession and the economy is in its weakest state since 2009.

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.

InDaily has changed the way we receive comments. Go here for an explanation.